Bear Markets are frustrating. They are exhausting. They test one’s discipline and diligent process big time. They bring out emotions, including hope.

Most importantly, Bear Markets are an exercise in patience. They are an exercise in having a process to methodically ascertain risk to reward and probabilities. Bear Markets are also required to cleanse the excess and rebuild a foundation for another Bull Market to ascend from. They are a natural part of the economic cycle as much as policies try to suppress them sometimes. Suppressing a Bear Market can make it worse. Much of why we are here today and why this one is longer is because many policies have been enacted to try to prevent the inevitable.

We will walk you through our disciplined review of where we believe we are, where we are headed, and what we have and will continue to position for.

One quarter is now in the books for 2023, with 3 remaining on the year.

Through Q1’23 here are some interesting performance numbers:

- S&P 500: +7.03%

- Barclays Aggregate (Bonds): +2.96%

- Gold: +8.03%

We believe two of those are in Bull Markets: Bonds and Gold. We remain overweight both.

We believe Stocks/Equities remain entrenched in a longer-lasting Bear Market, despite a very nice Bear Market rally in the first quarter. We remain underweight and defensive inside equities.

Our Fall piece was titled “Window of Opportunity for Bulls.” We said, “We see a few potentially encouraging developments that could create some Bullish sparks into the end of the year and the beginning of next. As our title suggests, the Bulls have a window of opportunity here of which to take advantage.”

We then went on to detail a few reasons a Bear Market rally was setting up nicely:

- Historically severe oversold conditions.

- Valuations becoming on the cheaper side statistically.

- Employment remained firm and Americans continued to spend. Unlikely earnings were going to fall apart.

- An economic data/indicator bounce was setup into early ’23 after being negative for much of ’22.

- Inflation was likely to come down and get a reprieve off the 9% highs, which would help a number of areas in the Economy.

- Seasonality is statistically the best from November to April.

Fast forward to the end of Q1 and we got just that. Severe oversold conditions have been relieved. The Market is no longer on the cheaper side, but back to the more expensive side. Employment has remained firm, and spending firm, but showing cracks now. Economic data got a soft bounce, and has now resumed rolling lower of late. Inflation got the big reprieve from over 9% to 6% currently. The favorable seasonal period from November to April is winding down.

Unfortunately, the Bullish reasons for a rally have all been met. A myriad of more Bearish prospects that have been brewing under the surface as this economic cycle appear ready to play out.

Simply put, we are looking for earnings to trough, or the Market to get cheap enough to price that in. So far, earnings have shown negative growth for just one quarter. Earnings are highly correlated over time to economic data/indicators. Unfortunately, and objectively, those economic indicators have quite a way to go before they show any signs of bottoming.

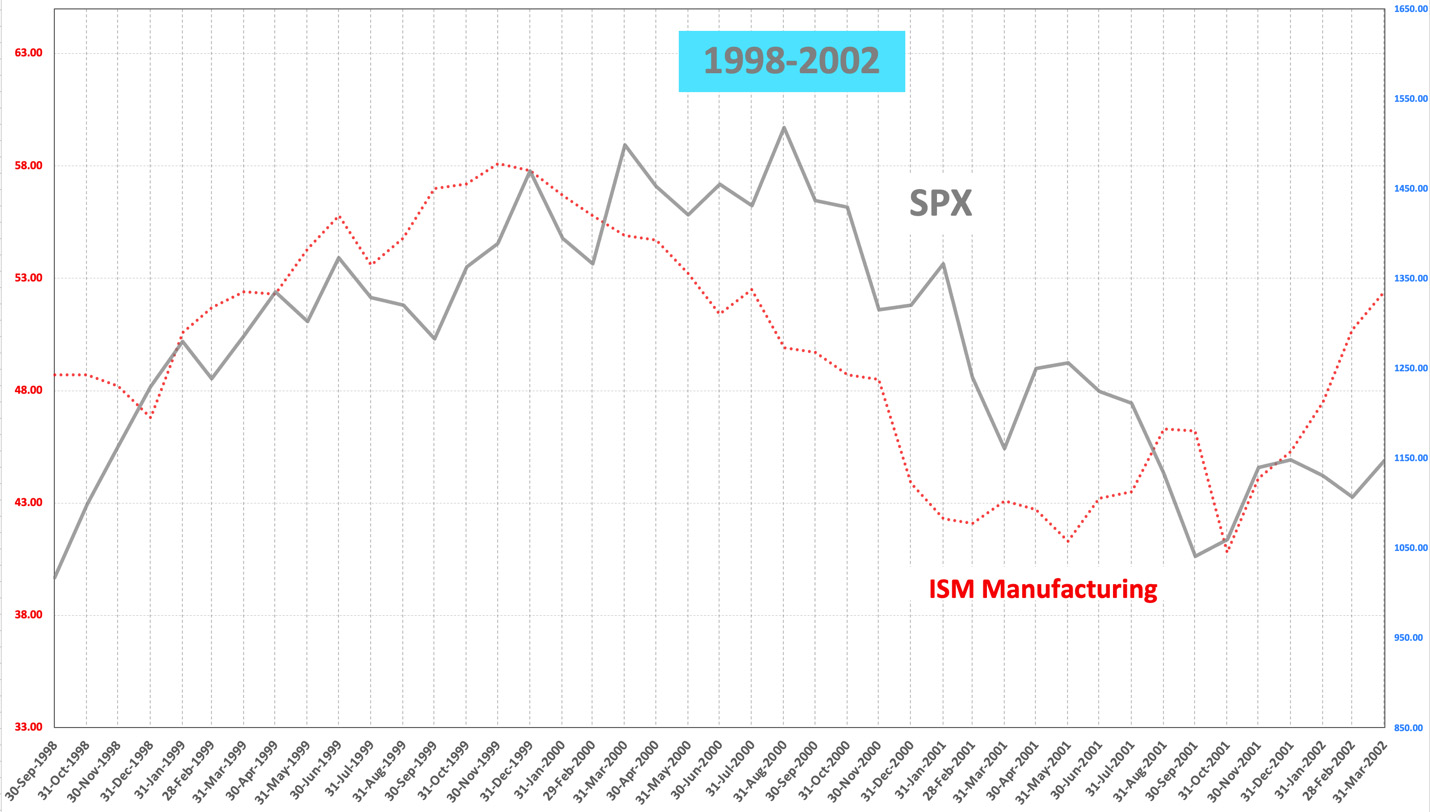

On the charts below, you can see Manufacturing in red and the S&P 500 in dark gray. They track pretty well during down cycles. In the time periods shown, 1998-2002 & 2007-2009, both the Market and manufacturing bottomed close together.

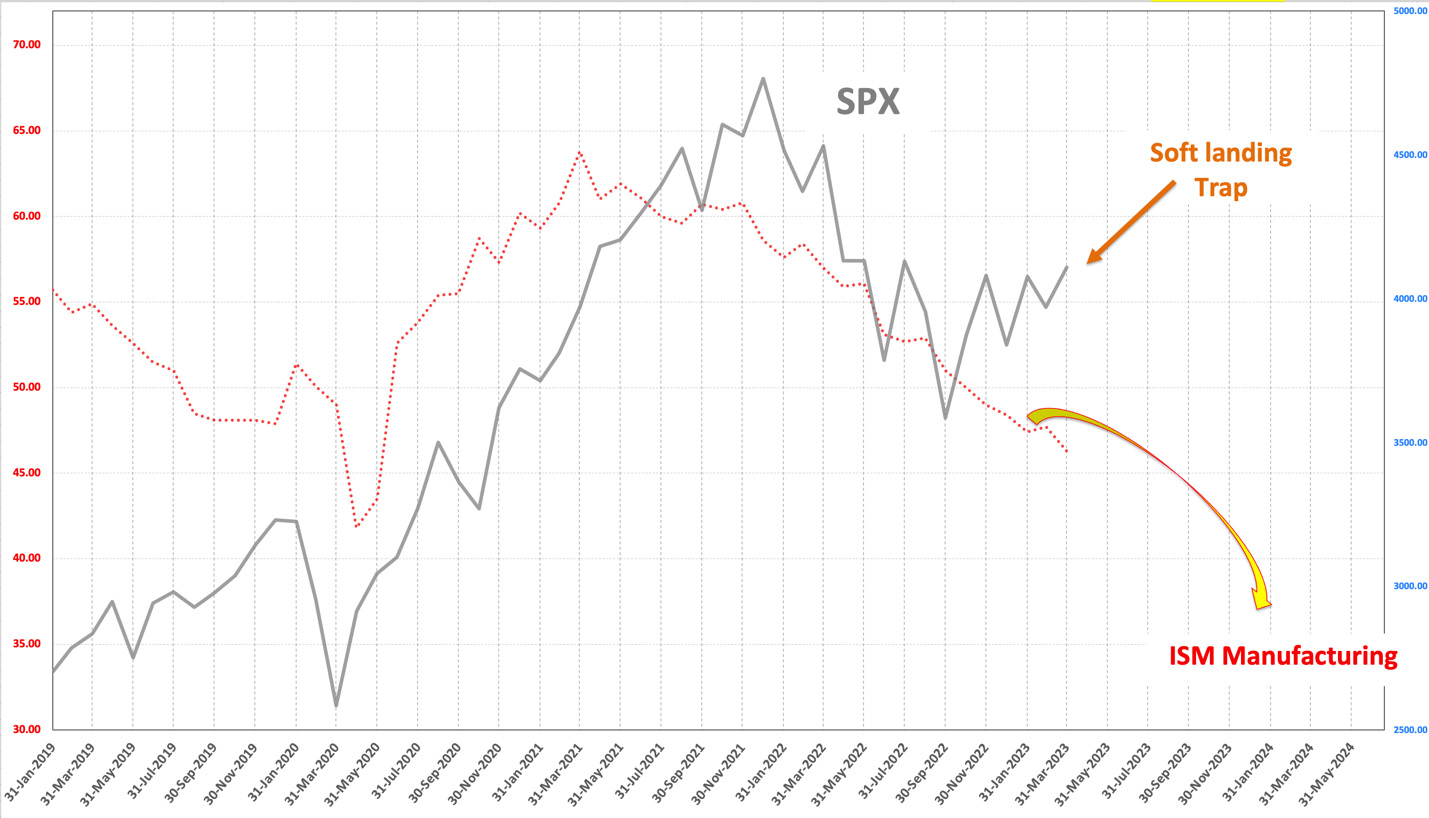

Completing the same analysis for the present time, you can see it’s tracking closely again this cycle. We drew the ISM manufacturing heading lower on the chart below. We have a myriad of leading indicators that support this likelihood for manufacturing data.

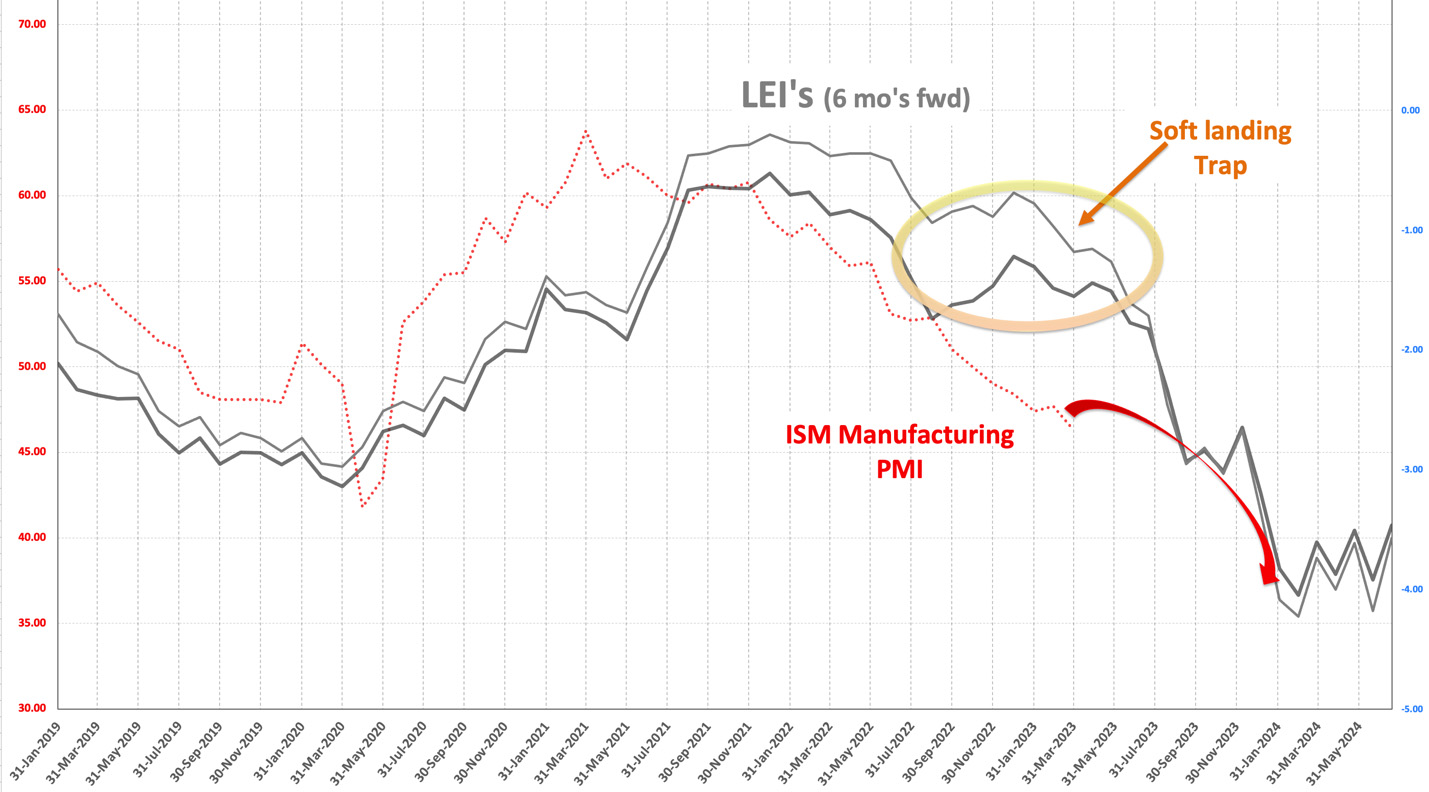

On the next chart, you see leading indicators (the gray lines), which we set forward 6 months on the chart below, are pointing towards ongoing weakness in the economic data (red line) through the end of 2023 and even into Q1 of 2024.

A lot of the economic pressure is coming from the velocity at which interest rates have risen. Our Economy is, for better or worse, pretty tied to the cost of capital (interest rates). The Fed has now gone on the fastest tightening (raising rates) cycle… ever.

The first rate hike from the Fed was March of 2022, or roughly one year ago. The lag from higher rates, due to Fed tightening, and slowing economic data is historically 12 to 18 months. So, the data we are getting today is just the beginning of the Fed’s tightening campaign. We are nowhere near seeing the full effects of what has occurred over the past year.

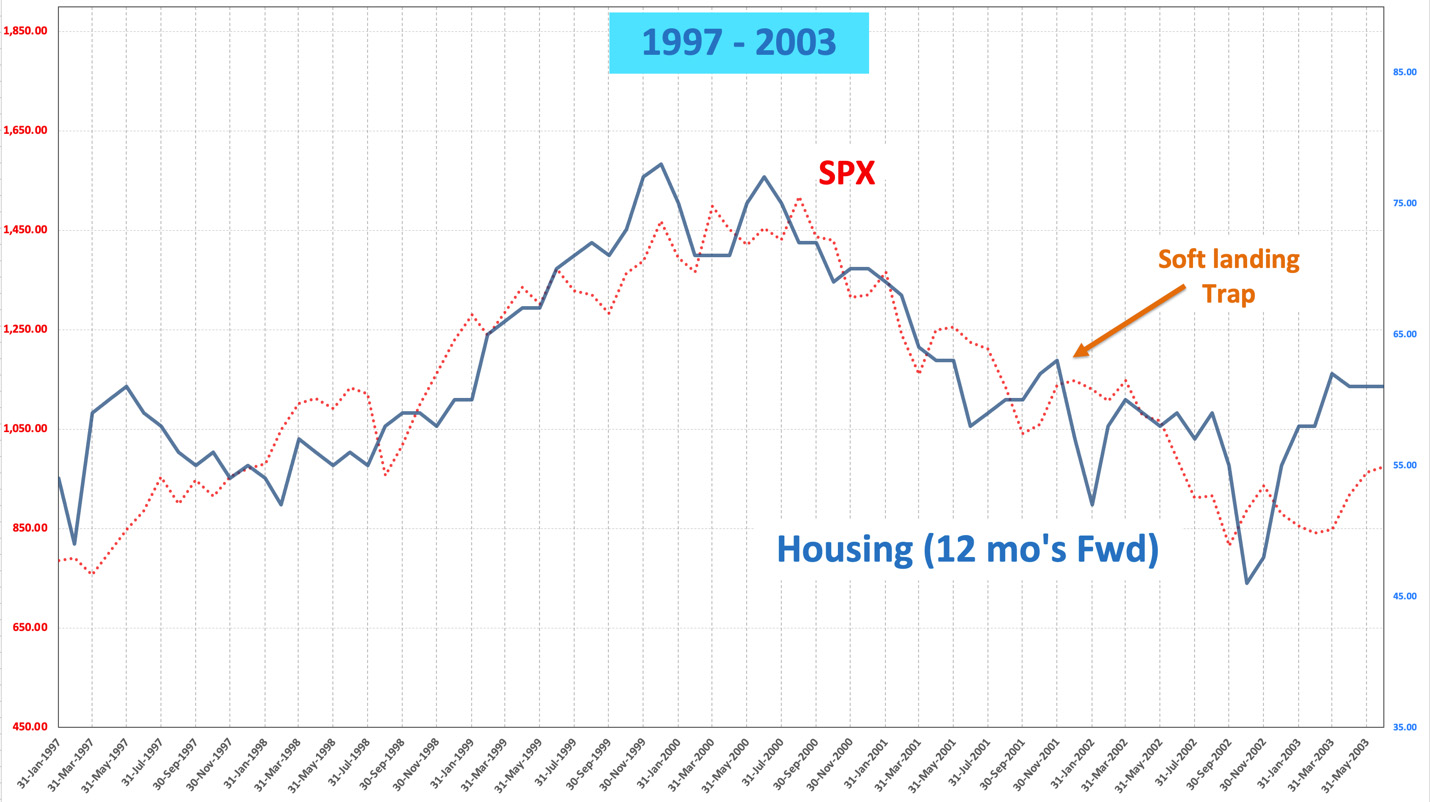

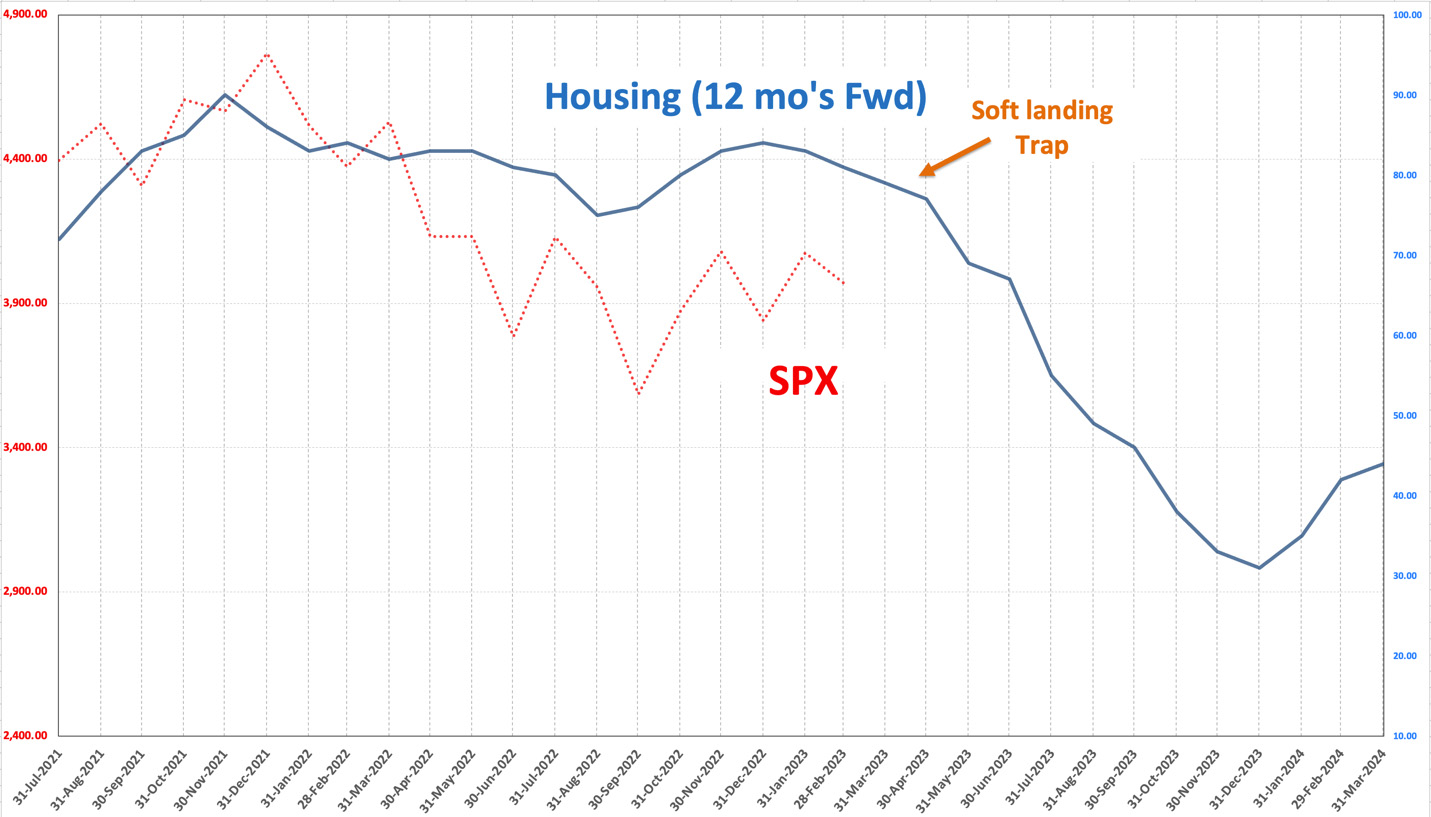

Interest rates put a lot of pressure on housing. Housing, when we look back throughout history, tends to lead earnings and the Stock Market by about 12 months. On the chart below, you can see housing in blue (set forward 12 months) and the S&P 500 in red. As housing goes, often the real Economy and Markets follow. You can see there were decent bounces along the way in housing (blue line). They were “soft landing” traps for casual observers.

Today the housing picture is, unfortunately, running through its advanced bounce time period. This is one reason last Fall, we saw that Bear Market rally setup. This signals a rough period ahead.

So far in this cycle, we’ve seen the following which are textbook markers or bogeys that happen in economic downturns:

- Housing peaks. (2021)

- Economic indicators. Data such as manufacturing peaks. (2021)

- Inflation persists and gives a spike higher to revenues. Prices are able to be passed on. (2022 story)

- Margin pressures start to be seen and build. Q4 of ’22 saw just that – Revenues were +5% and earnings were -3%.

- Cost-cutting begins and then sporadic layoffs or 2nd cost-cutting measures. (2022 story)

The 2nd part of the Bear Market often happens when the next markers of deterioration are seen. We have not seen these yet but are expecting them, given the points we’ve illustrated above.

- Revenues stall and start to hurt earnings more broadly, given the already-seen margin pressures. Earnings start to disappoint in earnest. (likely starting now or next few quarters)

- Layoffs become more widespread as cost-cutting is now deeply needed to keep profits. (next few quarters)

- Unemployment rate spikes, exacerbating the downturn. (2nd half ’23 likely)

- The economic data and earnings then continue to deteriorate together. (remainder of ’23)

- Then the economic data troughs / bottoms. (timing is unclear, but preliminarily we see Q4’23 or into 1H’24)

- A new Bull Market begins thereafter.

Bear Markets are tough. That said, there are plenty things to feel positive about. So let’s go over the positives:

First and foremost, we are anticipating this economic sluggishness to continue, so we can get in front of it.

We have shifted to a lower exposure to equities. Inside our remaining equities, we have increased the quality and lowered risk on a statistical basis. We have turned to defensive sectors and companies with positive free cash-flow, more attractive valuations, and higher return on equities. There are stocks in this environment that we think can outperform handily, just like in prior rough patches in Market history.

We have been excited about bonds since last Fall for the first time in over a decade. Bonds have been working very well so far in 2023 and we expect that to continue. We’ve made huge moves to the utmost safety in credit. We have our largest US Treasury positions on record. Our positions in corporate bonds are investment-grade credits. We are not speculating in High Yield or Junk Bonds.

We have continued to let our position in Gold build, and it has paid handsomely in 2023, as it’s outperforming equities year to date on the heels of not going down in ’22. We expect this outperformance to continue and expect there is more to go there.

We have an overweight cash position. Cash is finally earning attractive returns again, which we haven’t seen in 15 years!

We repeat: Bear Markets are an exercise in patience. We have plenty of patience. We’ve been through enough of these cycles to lean on our prior experience. Cycles are never the same, but they sure do rhyme.

We will make it out the other side just fine. We are positioned in a way that reflects what historically works in these macroeconomic setups. We are also positioned to be able to take advantage of plenty of opportunities that we believe are coming downstream. It’s a very powerful place to be in a confusing and difficult time.

The Market and our office will be closed tomorrow in observance of Good Friday. Happy Passover and Happy Easter. We’ll be back, dark and early on Monday.

Mike Harris