For those of you who would prefer to listen:

The results are in: Americans opened their wallets over the Holidays. Retail sales rose 5.6% in December compared to a year ago. Higher prices contributed to the increase, but not all of it. The Consumer Price Index (CPI) was up 3.4% in December. That was a sharp decline from the inflationary pressures in 2022. Inflation is going back in the right direction. To be clear, prices are still rising. They’re just rising at a slower rate than last year.

According to Gallup, Americans spent an average of $975 per person over the Holidays. That is nearly $100 more than 2022. Cars and clothes saw a pick-up in demand in December. Furniture and appliances did not. There are 2 pretty logical reasons for that: First, big-ticket items tend to get financed and higher rates made them more expensive. Second, those larger items are harder for Santa to get down the chimney. Gift cards seem to be increasingly a Santa favorite; Easier on the back.

Consumers have grown more confident about the health and direction of the Economy. They’re also feeling better about inflation. This, according to the University of Michigan. The monthly Consumer Sentiment survey came in at 78.8 for January. That’s its highest level since July of 2021. When you combine the December results, it was the best 2-month measure of optimism going back to 1991. That’s significant. The all-time low was reached in the Summer of 2022. America is a rollercoaster of emotions in these 2020s.

Consumer sentiment matters big time to America’s Economy. That’s because Consumer spending accounts for 70% of GDP (Gross Domestic Product). When people feel better about their economic situation, they tend to spend more. What’s interesting is the Michigan survey sure contradicts what political polls are indicating ahead of the November election. The Market is certainly looking past the politics, with the S&P 500 hitting a fresh, all-time high in the face of so many issues.

One thing Americans are increasingly not happy about: Tipping. It’s officially out of control. A study by the Pew Research Center indicates it is causing mass confusion and frustration. In response to the extended lockdown during the pandemic, people from coast-to-coast increased their tipping in order to reward frontline workers. Tips increased an average of 25% at full-service restaurants across the country and 17% at counters. Despite the increasing return to normal, tips have not returned to their pre-pandemic levels. And the requests for tips have significantly expanded.

Background: Tipping has been largely an American thing. It has not historically been customary in foreign countries. In fact, it’s often considered rude in Japan because good service is supposed to be standard.

Tips have been traditionally given to workers who earned the so-called “tipped minimum wage.” That wage was set by the Federal government at $2.13 an hour. That’s why restaurant employees rely on tips to earn the balance of their income. Tips were considered a reward for the human effort and the care in service provided. Now tipping has spread to occupations that earn the regular minimum wage or above. It’s important to know that starting in April, fast food restaurants in California are required to pay their employees $20 per hour. Starbucks pays its employees a minimum wage of $15 across the country. Many other organizations do as well.

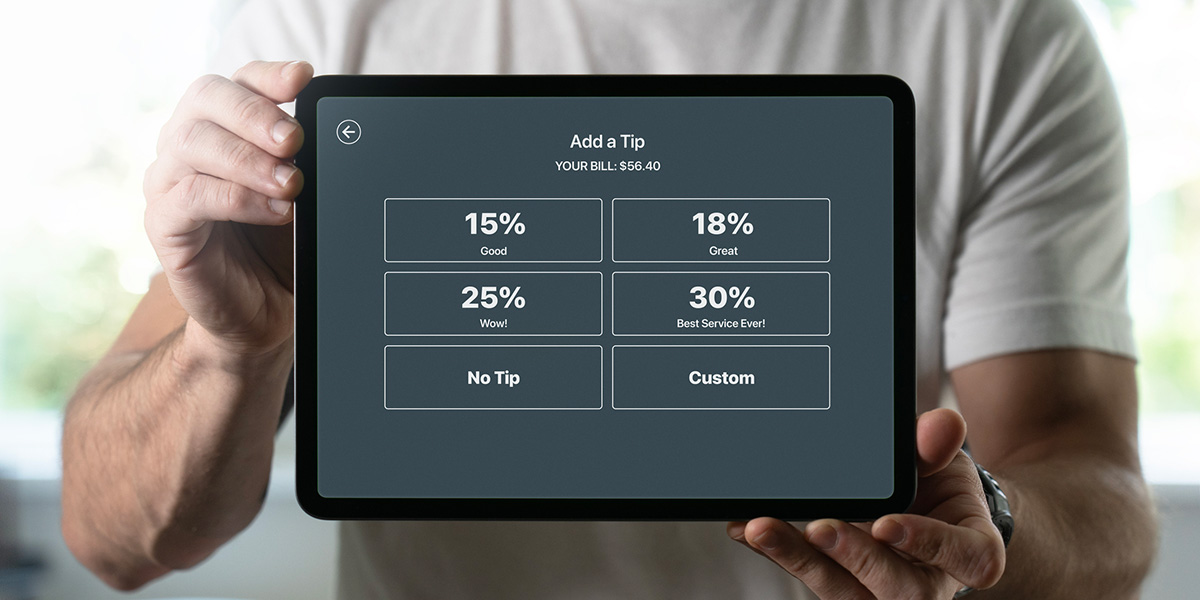

We consumers are now constantly facing digital kiosks that ask for tips that often start at 18% and can go as high as 30%. It’s expanded way beyond restaurants, even landing at self-service counters at the airport and stadiums. Think about that. We’re being asked to tip someone else when we do the work while paying for the product. In other words, paying someone for doing nothing. Things have changed so much since the days when 15% was the standard rate for tips.

The biggest driver of this expanded tipping has been the rise of point-of-sale technology. It’s those digital devices that swivel for ease of use and ease of pickpocketing. Should we feel obligated to add a tip of 20% or more when little to no service has been provided? It’s an important, yet awkward situation, at a time when prices have already been jacked up by inflation. People feel uncomfortable with this issue as the representative watches your move, while people behind in line might have visibility too. What’s more, companies have been known to set the baseline tip at 18% or even higher because it generates more revenue. Sometimes, it’s not clear if the tip is calculated before or after tax. It’s like a guilt trip. The result has been “guilt tips.”

Here’s the other thing: We are being prompted, if not forced, to tip before the service is even rendered. It completely reverses the order for the very reason for the tip. But if you don’t do it, you run the risk of really bad experiences. Case in point: Food delivery apps. Front-loading a tip is not only customary but necessary for the order to even be picked up. Drivers will look at the tip and your history with the app before they decide whether they want to accept the delivery. And even if you give a huge tip, you still might get the food late, cold or wrong. In fact, you still might not get it at all.

There’s more: It’s not only human workers who are asking for tips. Services like GoFundMe, a platform that helps people raise money, often for emergencies, request tips. There are also processing fees associated, which get deducted before the recipient receives the money. That seems dishonest. That also seems very typical today.

I consider myself a generous tipper when good service is received. Working at a restaurant in college taught me a valuable lesson; It’s really hard work. I think everyone should do it at some point to truly appreciate what it takes. Upon buying a coffee this week, I was prompted to tip as expected. My order is pretty simple: Large black coffee. It doesn’t take much effort. It was $5 and I tipped $1 anyway. But out of complete curiosity, I asked the lady at the register if everyone tips. She said most do, but not everyone. But the most interesting part was she went on to thank me for the tip, but that I didn’t need to do it based on my order. I asked her if she tips in this situation, and she said no. And I quote, “Everything is so expensive, and tipping is getting ridiculous!” There you have it. We were in total agreement. That was the inspiration for writing this piece.

Bottom line: Tipping is and should always be for service. Our professional opinion is, if someone provides excellent service, it’s naturally appropriate to tip accordingly. Consumers should feel comfortable with what they tip and shouldn’t be guilted into paying more. Doing some fresh investigation, what I gather as a general rule is that somebody behind the counter at a coffee house or a check-out screen is being paid minimum wage. There should be no obligation to tip. If the service is worth it, by all means, do so. But that should be your choice. There are increasing signs that guilt tipping is backfiring. A Cornell University study found that larger suggested tips resulted in increased gratuity but not increased customer satisfaction nor retention. People are pushing back. When tipping is no longer a choice, it’s natural for people to feel resentment. It’s not good business.

Back to the Market: The S&P closed Friday at a new all-time high, eclipsing the previous high last reached in January of 2022. 2 years of sideways. That’s not right. It’s actually been a rollercoaster.

We’re just 3 weeks into the new year, but Tech is showing its staying power. It’s leading the charge once again. The themes of Artificial Intelligence and Fed rate cuts have been fueling stock prices. 2023 was dominated by the Tech Titans. The rally broadened out to end the year. It’s narrowed again to start the new year. Participation has thinned. Tech takes over earnings season starting next week. Expectations have gotten pretty high. We shall soon see if they deliver.

Have a nice weekend. We’ll be back, dark and early on Monday.

Mike