With just 1 trading day left in the month, the Stock Market is having one of its best Augusts ever. It’s the story of the Market in 2020: a series of worsts followed by bests. The Dow just joined the S&P and NAS to go back in the green for the year. August is usually a tough month for stocks. Not so this year. It is setting up to be the best August for the Dow since 1984, the best August for the S&P since 1986 and the best August for the NAS since the year 2000.

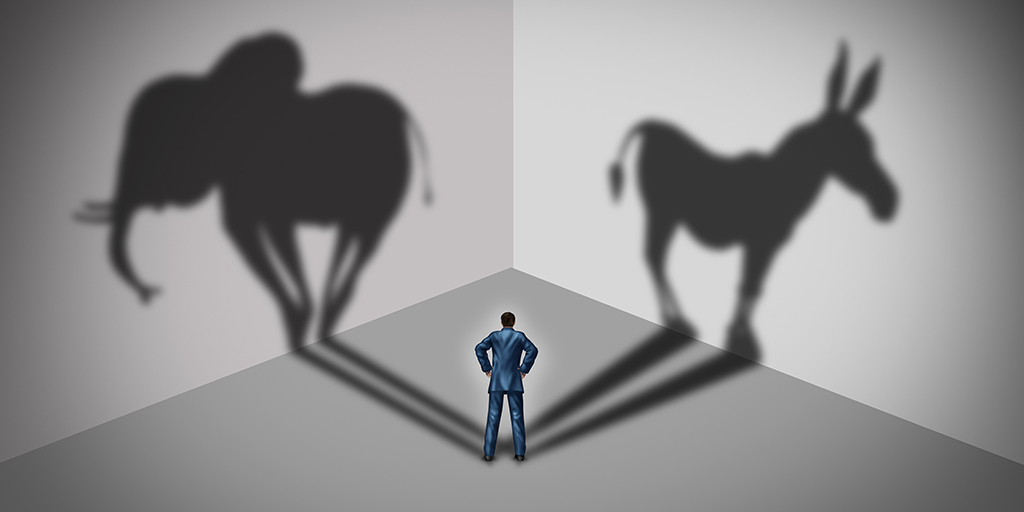

This week, Republicans held their Presidential convention which followed the Democrats last week. Despite stark differences in style and vision, both Presidential candidates agree on one thing: They said this election is the most important election of our lifetime. It’s very hard to disagree. And there’s very little that Republicans and Democrats agree on.

Both events this year saw lower ratings than the 2016 conventions. Perhaps that should not be a surprise. The growing polarization in the country means that fewer people were likely to tune in to the opposing side’s convention. It also indicates that the undecided voters decided not to watch what has been described as the 2-hour political party infomercials, for 4 nights.

Both parties painted dark pictures of the direction of the country if the other opposing candidate were to be elected. Republicans had the advantage of going second, which allowed them to respond to many of the criticisms launched by the Democrats. Trump continues to maintain a lead over Biden on the issue of the Economy, which many poll participants rank as their top issue in the 2020 presidential election.

“It’s the Economy Stupid.” Those famous words were first declared by Bill Clinton’s campaign strategist James Carville in 1992. Despite having a 90% approval rating in the wake of Desert Storm, an economic recession in 1992 derailed George H.W. Bush’s bid for a second term. Ross Perot didn’t help either. The message was clear, Americans vote with their wallets.

There are so many polls out in circulation these days, and confidence in the accuracy has been compromised since the 2016 election. But there is reason to believe that pollsters are being much more thorough today and it’s pretty much all we’ve got to work off of. So here goes:

This week’s recent Gallup poll showed 50% of voters listed the Economy as one of the three most important issues facing the country, followed by COVID-19 (41%) and health care/drug prices (35%). No surprises there. Interestingly, 72% of respondents rated their personal financial situation as “excellent or good” compared with 28% who responded with “poor or not so good.” 76% rated their own job security as “excellent or good” compared with 24% who responded with “poor or not so good.” 51% of responders approved of the way President Trump is handling the Economy compared with 49% who disapprove. 56% approved of the job Trump is doing handling the Stock Market compared with 44% who disapproved. This with the Market at all-time highs. As stated above, President Trump continues to edge out Former Vice President Biden on handling the Economy.

It is indeed a popular belief that this election is one of the most consequential in American history. The results will no doubt set the course for the rest of the decade and beyond. It seems as though we are facing a once in a century crisis. There are some major similarities when you compare the 2020s to the 1920s. Both started with serious challenges; Life-altering challenges. Planet Earth was anything but peaceful and stable in both periods.

The 1920s began on the heels of World War I, which was also impacted by the Spanish Flu pandemic of 1918. That disease infected roughly 500 Million people and killed as many as 50 Million. Keep in mind, the global population was less than 2 Billion back then. That implied a 28% infection rate. The death rate was roughly 3%.

Both of those statistical rates are significantly lower for the COVID-19 pandemic today. The population on Planet Earth is now approximately 7.8 Billion. There has been a running total of 24.5 Million cases and over 832,000 deaths worldwide as of this morning.

Both of these decades, a century apart, started with recessions. In fact, the Roaring ’20s, widely considered one of the most prosperous periods in American history, actually had 3 recessions during the decade. Statistically, and perhaps surprisingly, 4 of the 10 years of the Roaring ’20s were in a recession. That I did not realize until now.

The Dow peaked at 119 on November 3, 1919 and dropped nearly 50% to 63 by August of 1921. That was exactly 99 years ago. But then a roaring Bull Market began, with the Dow soaring 497% to peak at 381 on September 3, 1929. That decade-long rally was one with few peers, mostly compared to the Dot-com days. It then crashed again, to the tune of 89% to finally find a bottom at 41 in 1932.

The last few years have brought boom & bust cycles too. We experienced it in 2016. We got it again in 2018. And this year, 2020, has been one for the ages. We saw the fastest fall from Bull Market to Bear Market in history. We saw unemployment go from 3.5% to near 20%. We saw the fastest recession in history. We have now seen the fastest return to Bull Market from Bear Market and the seemingly shortest recession in history. Crash down followed by crash up. That’s 2020. The Stock Market this Summer has been stubbornly strong; Ridiculously strong. The external pressures have been fierce. Hot wars, cold wars and a pandemic. But studying things closer and going wider, they aren’t as unprecedented as one might think. It might just be a once a century kind of thing. That said, 2020 isn’t over yet.

Have a nice weekend. We’ll be back, dark and early on Monday.

Mike