This week on Wall Street was all about the Fed.

We wish it wasn’t this way frankly, but this is the direction markets have taken since the financial crisis: an ever more reliant relationship between equities and central banks.

Before we dive into the Fed and monetary policy, we want to highlight some unique abnormalities in intermarket relationships we monitor closely that occurred this week:

- Bond prices are making new multi-year cyclical highs, inversely, bond yields are making new lows. The 10 year Treasury dipped below 2% for the first time since late 2016

- Gold prices are making new multi-year cyclical highs pushing through $1,400 an oz this week (first time since 2013)

- The S&P 500 made new multi-year cyclical highs late this week.

- The Dow did not (although it was quite close)

- The Nasdaq did not (just over 1% away)

- The MidCap 400 *mid caps* did not (6% away)

- The Russell 2000 *small caps* did not (11% away)

- The Transportation index did not (11% away)

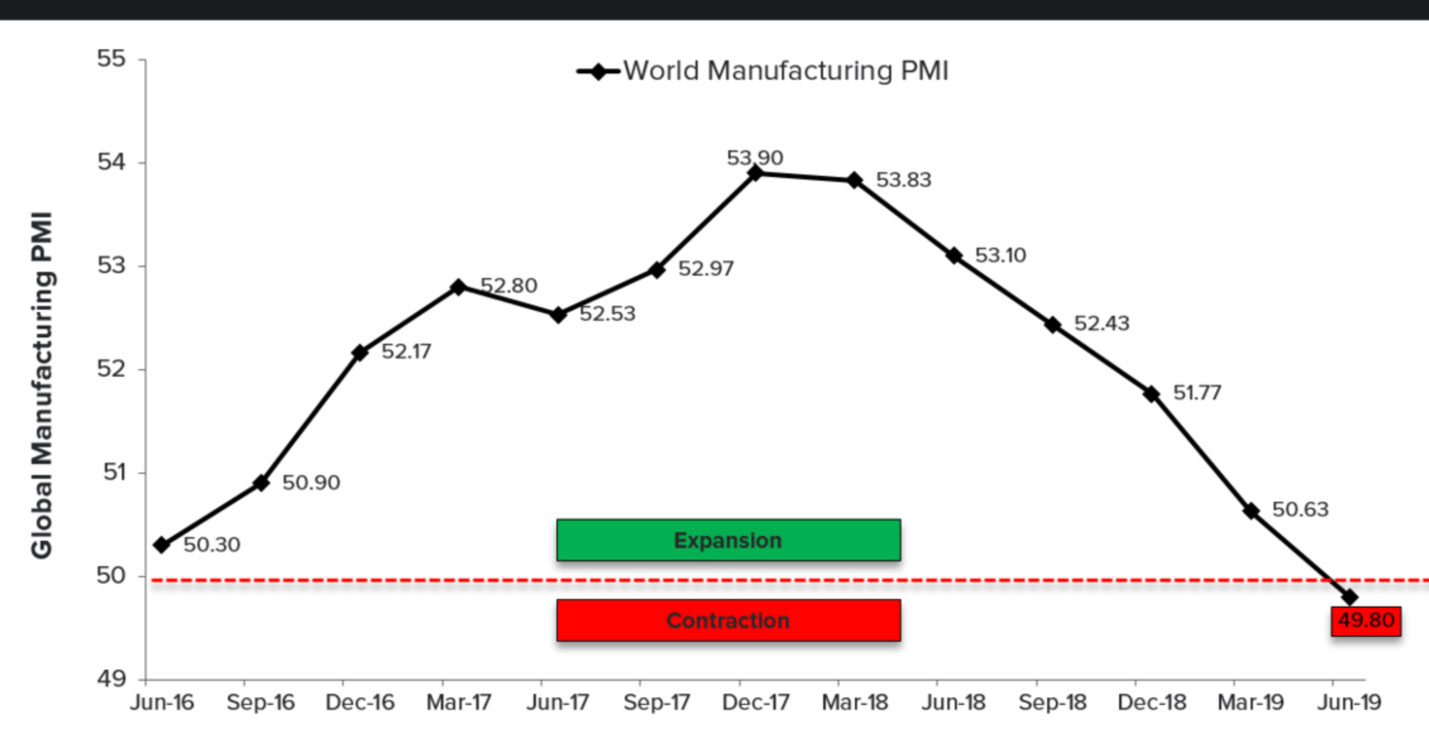

- Manufacturing in the US and globally is making new multi-year lows as well as many other economic data points.

That is a sample of some of the somewhat opposing intermarket relationships going on at the moment. In layman’s terms, these can last in the short run, but the divergences do eventually close the gap in the long run. So this boils down to two scenarios: Data gets much much stronger and the bond market proxies start to go the other way, confirming economic strength. Or stock prices need to come back in (lower) and align with what the economy and bond market are saying (more detail on this in our upcoming quarterly newsletter!).

After all the buildup the Fed voted to hold the Fed funds rate steady at 2.25-2.50%. This met with market expectations, though some were silently expecting an actual cut.

The vote featured the first dissent of Fed Chair Powell’s era, with St. Louis Fed President James Bullard favoring a 25bp June cut. The FOMC (Federal Open Market Committee) moved away from its prior “patient” language in the statement, as the eight policymakers shifted their 2019 views indicating their views that cuts may be ahead.

Fed Chair Powell’s tone at the press conference was much more dovish than in May, with his opening remarks reiterating the Fed’s overarching goal to sustain economic expansion, with a strong job market and stable prices. He highlighted that “many” policymakers see that the case for “somewhat more accommodative policy has strengthened” since the May meeting.

He outlined several factors behind this shift, including a slowdown in the growth of business income, declines in manufacturing production, weaker business sentiment, and the “crosscurrents” of trade disputes and the overall global-growth picture. He is seeing data like the chart below. Global Manufacturing is contracting for the first time since early 2016.

After this week’s Fed meeting, the Market is now pricing in close to a 100% chance for a cut at the July FOMC meeting. Many analysts’ views have been for the strong possibility of a June hold and a July cut (after some possible clarity on trade following a Trump-Xi meeting at the G20 later this month).

What’s amazing to sit back and think about: the last time the Federal Reserve cut interest rates was December of 2008; just shy of 11 years ago. The S&P 500 closed that rate cut day at 885. Yes, a three-digit price. The unemployment rate was pushing 8% and we were in one of the worst recessions our country has seen.

Today, we are at maximum or full employment, GDP is growing 2+% and the Stock Market is near all-time highs. Highs which are 4+ times the value we bottomed at in the Spring of 2009.

We understand the need for the Fed to keep the expansion going or create a soft landing for the economy, but we are nowhere near crisis or entering crisis at this juncture and that’s what concerns us for the long run. This seems very normal to us: the economy was really strong entering 2017 after expanding for nine years, overheated a touch and now needs time to come in and heal a bit. A pause that will ring out the excess or slack in the economy and not push us nearer to another asset bubble.

Pre 2001, recessions or mild bear markets where much more routine and mild. They happened every few years on average and allowed stability to build off. Does anyone remember those recessions where equities would fall between 15% and 25% as the economy would come in?

The problem is everyone’s recent or present history lessons for recessions are that of 2008 and 2001, both of which were historic for their negative equity performance losing 60% on avg. Those were not normal! Unfortunately, these last two are more the exception than the rule. But somehow, we don’t want to allow for a normal retracement these days, because those wounds are still so fresh.

Interest rates pre-crisis were well over 5%, so there was a lot of ammo for the Fed to cut rates to stimulate the economy. The Fed funds rate, which went from 5.5% to 0%, has only made it back to 2.5% currently, 10+ years into the recovery. Our fear is the Fed is flirting with zero-bound rates, which is the exact inescapable problem Japan and Europe are facing.

Once you go down that path to zero-bound rates, it is unprecedented so far to ever get out of it. Japan is more than a decade plus in, Europe not far behind.

Right now, global macroeconomic data and US stock prices are diverging like we have not seen in a long time. The Market is now making a bet that Central Bank easing will be able to reverse these strong negative global economic headwinds quite quickly. We are not big believers that this can be achieved.

We have much much more to say on this topic and current market conditions in our Quarterly Newsletter and Technical Analysis coming out next week. So stay tuned!

Enjoy your weekends. We’ll be back, dark and early on Monday.

Mike Harris