The October shakeout continued this week. Investor psychology has been pushed, tested and stretched. Stocks got beat up. There were some signs of capitulation this week, where investors panicked and couldn’t take it anymore. Relentless selling does it every time. It might spill over to next week. Even with our defensive positioning, we still felt the pain. This sell-off has left very few places to hide. Bonds, Gold and Cash were at the top of the narrow list.

I was in New York this week, at an investment strategy session at JP Morgan. The timing was near perfect. Everyone was looking for insights and fresh perspectives on what’s going on.

Nine and a half years of Bull Market has not experienced a 20% decline. It’s the longest stretch in history. The thing is, people are obsessively worried about the next Bear Market. It’s understandable. The last 2 were down over 50%… That is not normal. Crisis is not typical. Corrections, consolidations and recessions are. There are no signs of recession on the horizon, just a hint of “slower growth” in the air. There is a solid foundation under this Bull Market. Fundamentals are still very strong.

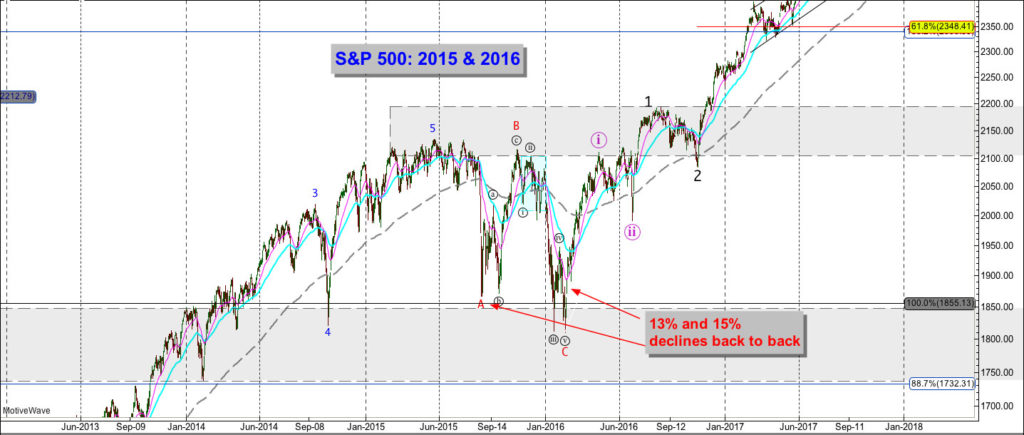

When indiscriminate selling takes hold, as it did this week, fundamentals just don’t matter as much. We want to remind you this isn’t the first time we’ve seen this type of selling since this Bull began in ’09. It has actually happened over 10 times where we have witnessed 10% moves down off recent price highs. The most recent example of this was in the 2015 -2016 where we had very violent 13% and 15% declines back to back in a very short time frame. Both of those sell-offs lasted just over a month and we pointed them out on the chart below.

This is late cycle however and we are 2 years further along than the last correction we showed you above. This Bull Market is maturing. The longest economic expansion ever was 10 years. This one is currently 9. But it is very different from periods past. It’s been very slow, like a healthy tortoise. There has been no boom to bust. The US economy did accelerate its growth rate this year, with help from the tax cuts. The problem is, the tax cuts were like 70% sugar. I heard it called “Krispy Kreme economics” this week. And it happened when our unemployment rate was already at historic lows. The economy requires more protein. Rising wages and corporate profits fit this bill. Some people are suckers for sugar though.

2018 has been a standout year. For good things as well as not so good. For investors, it’s been a challenge with gains that were erased. This year was the first time since 1960 that the S&P fell 10% twice in a year. Throw in the Bond Market which has only been down 3 times since 1974. This year is on pace to be the 4th as interest rates have risen.

Our sense is this correction is approaching a near term bottom. We are 1 month into this steep decline which isn’t dissimilar to moves like this of the past. Wednesday of this week was the worst of the selling when you look under the hood. There was basically nowhere to hide. Individual stocks got sold more so than the benchmark indexes. That doesn’t happen a lot, but when it does it often leads to bottoms being near. Today’s selling was different, it wasn’t as relentless across the spectrum of stocks. There were some areas that were up on the day today, much more so than Wednesday. Often times in bottoming price action the worst of the selling in stocks comes after the mid-way point to 3 quarters mark, and then the indexes often make lower price lows to finish it off. This is called positive divergence and is a good sign. Today was the first day we saw that.

We are very mindful that Bull Markets don’t last forever. We still think this one has more to go. But this correction will certainly test that. We switched gears to play defense once we realized this selling could perpetuate. Today that positioning provided some good cushion. The US economy is still growing. Inflation is contained. The Fed is just normalizing interest rates. The recalibration process has caused shockwaves. Remember, they started from zero. We still expect another rate hike in December. Buying low is much harder than it sounds. Wall Street is the only market where sales spook buyers.

Earnings matter more than ever. Earnings have been super strong. Earnings growth: Q1 27%, Q2 27%, Q3 so far 30% (given 56% that have reported). But at this stage, guidance matters more. Amazon reported very strong numbers but lowered expectations for the rest of the year.

A couple weeks ago we made an allocation shift as well. The higher interest rates drove it. We moved money back into Fixed Income. We accelerated with the Stock Market sell-off. Though we are long-term investors, we understand short-term risks and are always seeking value while managing risks. We don’t see the volatility letting up until after the midterm elections and perhaps when there is more clarity on trade with China.

Keep those belts buckled. We will get through this. Rest assured, we’ll be back, dark and early on Monday.

Mike Frazier & Mike Harris