After an action-packed 2 weeks, we find ourselves quickly through more than half of earnings season with 294 out of 498 S&P 500 companies reporting thus far. Revenues are up nearly 27% and earnings an astonishing 99+%. On first read, that sounds incredible, which it is, but remember the +99% comes off the lowest base effect or comparison we will see out of this recovery. Q2 ’20 was a disaster with everything being shut down, so earnings were the lowest we’ve seen, dating all the way back to 2012.

So is this peak earnings growth? Our answer is very likely YES. Should you be worried? NO… which I’ll get into detail about in a second. We are very unlikely to see 99% growth rate surpassed as this recovery continues and as we move toward next quarter, we’ll have tougher comparisons than this quarter and on and on. Think of it this way 99% earnings growth is a 1-time event and an outlier….just as last year’s -38% drop for Q2 ’20 was a 1-time event and an outlier. So the media’s recent talk about peak earnings growth is a bit misleading as this is what happens every cycle off a trough comparison. As earnings climb back and the economy recovers, the prior year’s quarterly earnings continually climb higher and higher, thus making the % growth or rate of change off that higher number incrementally more difficult moving forward.

This time is no different, and as long as revenues continue to grow and earnings flow through to the companies’ bottom lines, this economic acceleration has plenty of legs. Peak rate of change growth does not mean the end of growth of aggregate earnings or the demise of this Bull. Let me explain.

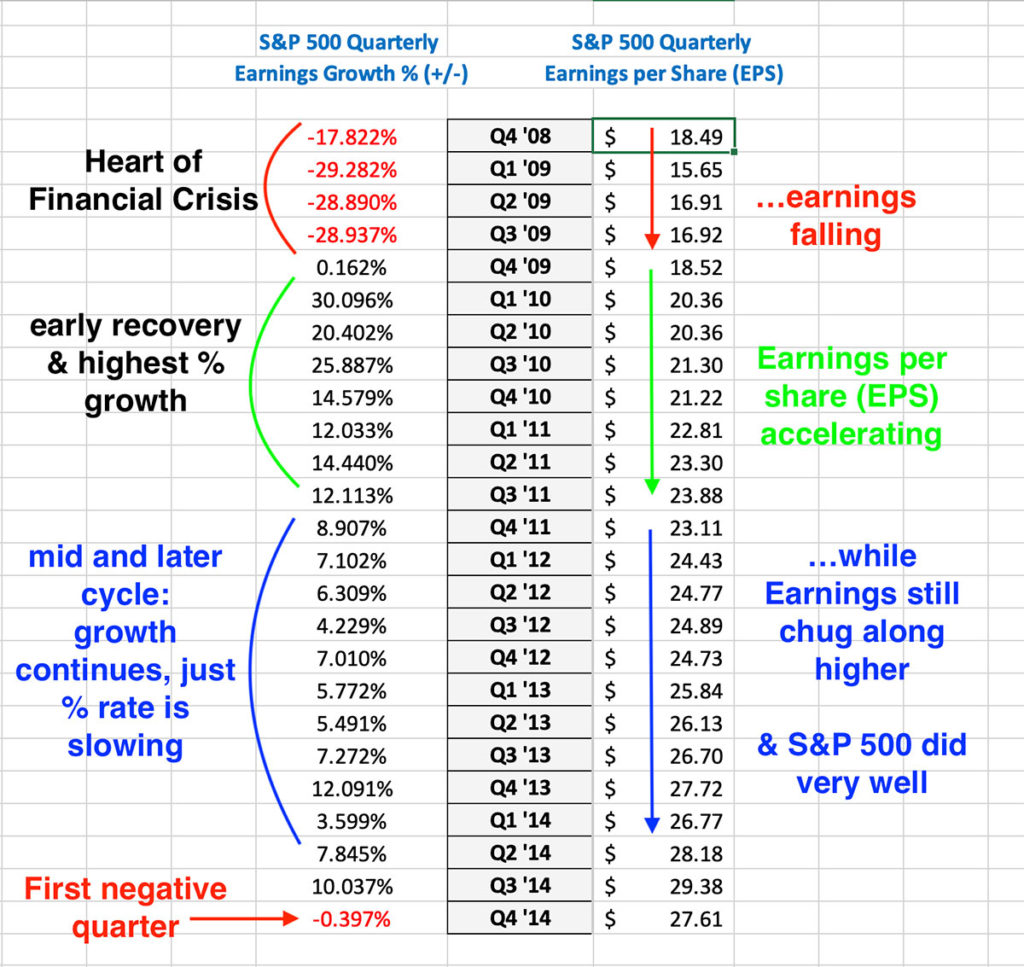

We illustrate below the same kind of situation that we went through in 2008-2009, or the Financial Crisis, and the recovery out of it. The worst of the recession is where earnings always drop the fastest, thus creating the worst of the Market action. Then comes the initial recovery out of those earnings collapses, which always shows the most spectacular % growth of earnings. As you can see below, coming out of the Financial Crisis, earnings eclipsed +30% in Q1 ’10 and continued on with over double-digit growth for most of 2010 and into 2011. Q1 2010, where S&P 500 growth peaked at +30%, was not the end of the recovery or the Bull Market. It was actually quite early into the Bull Cycle. This time will, of course, be a little different, but the mechanics of the structural part of how earnings growth inflect are very much the same.

Notice how, from 2011 all the way through 2014, the growth rate stayed consistently under 10%, while the EPS on the right-hand side continually moved up. This also coincided with very good years for the Markets as they continued to move higher with earnings even though the growth rate was decelerating. We will likely see something very similar to this today. We are not sure this can sustain multiple years moving forward, but another year plus or maybe more makes logical sense. Let us show you.

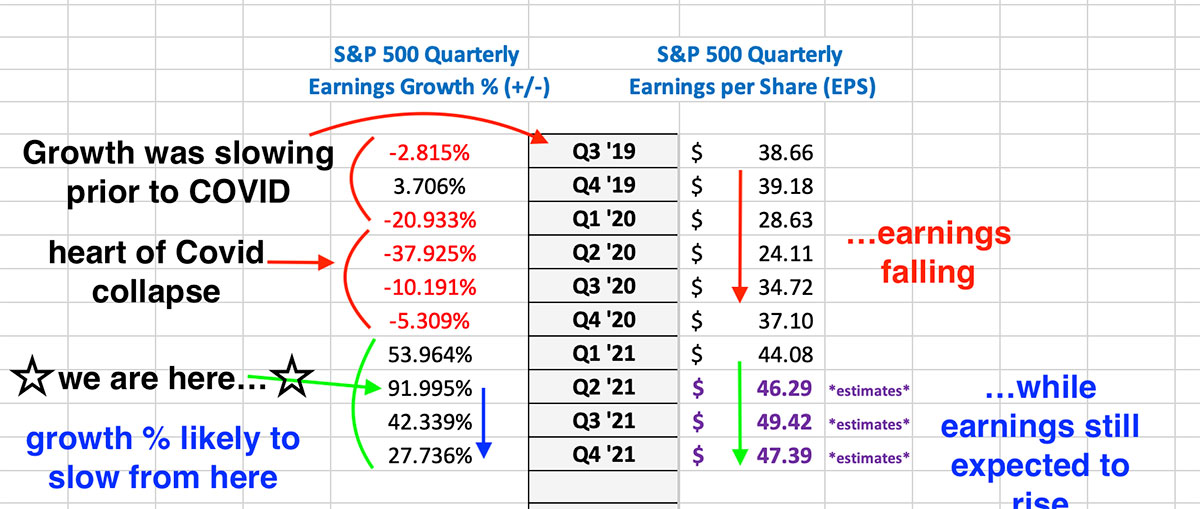

Just like getting lost in a gigantic shopping mall (they still exist, I think…) I gave you the *WE ARE HERE PIN* below. As you can see right above there and very similar to the Financial Crisis slowdown and recovery, earnings fell 20%, 37% & 10% during the heart of Covid. This quarter or the *WE ARE HERE PIN* is more than likely to be peak growth rate for earnings. Earnings likely have well into ’22 to continue to chug higher even as the year-over-year growth rates begin to normalize, just as they did in the prior example above coming out of the Financial Crisis. It’s very normal, healthy and expected.

So peak growth rate yes, but peak aggregate earnings… very unlikely in our estimation. Normalizing the growth rate as earnings continue to chug higher is still a very good spot for Market conditions.

Have a great weekend. We will be back dark and early Monday.

Mike Harris