“Wall Street has a few prudent principles; the trouble is that they are always forgotten when they are needed most.”

– Benjamin Graham

For those who have not heard of Benjamin Graham (1894-1976), he has been referred to as the “Father of Value Investing” and the “Dean of Wall Street” with his sound investment principles and sayings. Graham created and taught many principles of investing safely and successfully over the long-run. Modern investors continue to use many of them still today. While most people know Graham best for being Warren Buffett’s mentor, he had many lasting positive contributions to the world of investing.

If Mr. Graham were alive today, he would be left scratching his head the past few years and even more so the past 13 months, alongside his pupil Mr. Buffett.

Why is that?

Well, there is an interesting dynamic at play that is an unintended consequence of the Federal Reserve’s current policies. The Fed’s monetary policies regarding interest rates and combo balance sheet expansion have caused a yield curve term structure (think bond yields/interest rates) and liquidity infusion, which has demonstrably affected the performance of GROWTH Stocks vs. VALUE Stocks.

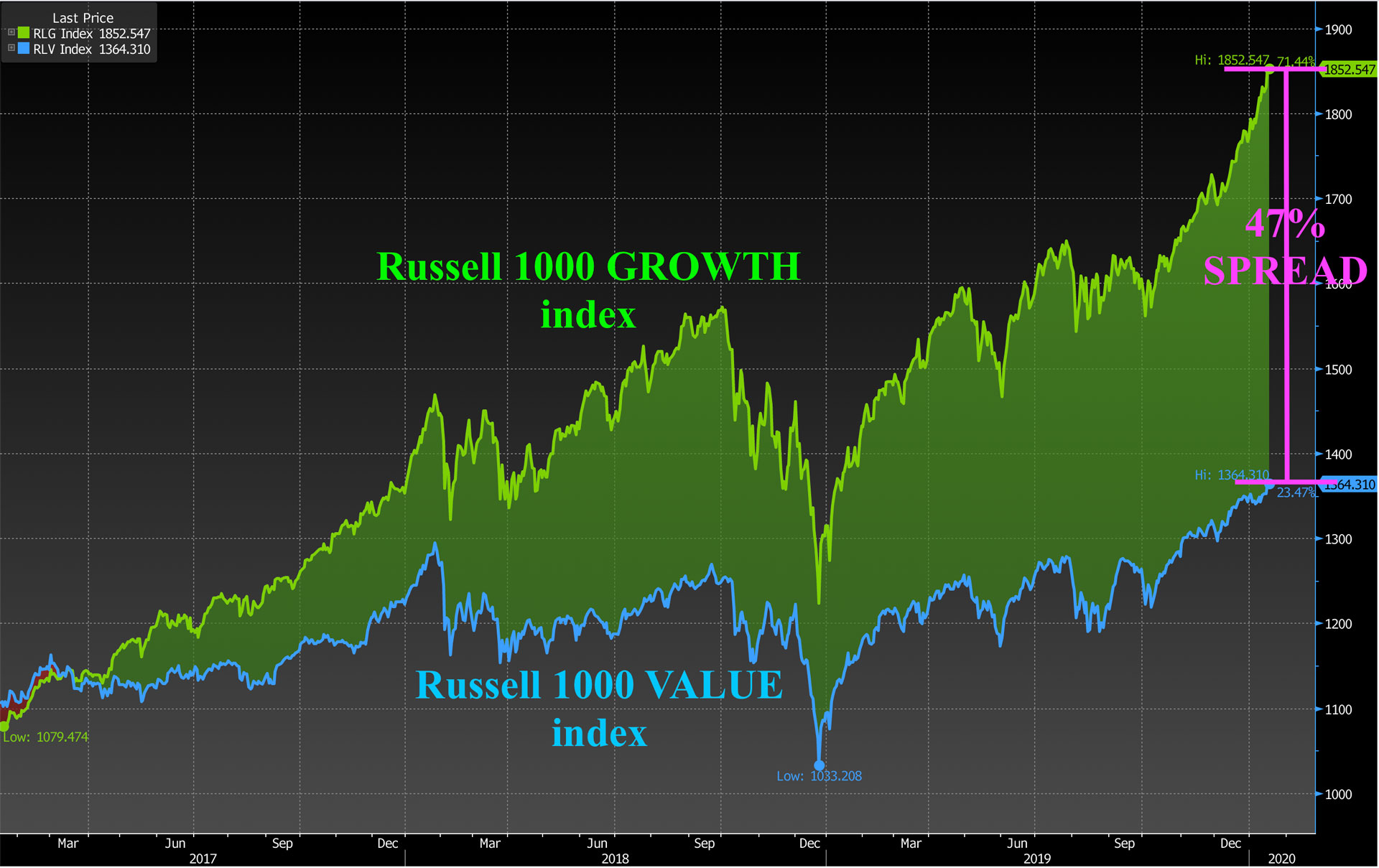

Mr. Graham and Mr. Buffett are “Value Investors,” which means sticking to key valuation metrics and discipline to construct their equity/stock portfolios. Simply put, in today’s markets that means drastically underperforming the benchmark indexes. Shown below over the past three years, you can see Growth stocks (GREEN) have outperformed VALUE stocks (BLUE) by an astonishing 47%.

The benchmark indexes have become more and more heavily weighted to Growth stocks as they have increasingly larger weights as their stocks’ prices have continued to appreciate. This has created a very difficult landscape or backdrop for traditional or pure “Value Investors.”

Now, we at Bedell Frazier have a hybrid methodology between Growth and Value investments and toggle our exposure between the two, we thankfully have had exposure to Growth stocks. But, we have also seen our more value-oriented investments frustratingly underperform in this recent environment.

To try to make the Growth vs. Value spread implications real, last year Berkshire Hathaway generated returns around half what the Dow did and less than 40% of the S&P 500. Has Mr. Buffett lost his touch? Should he change his investment principles and rules, throw in the towel, or retire? Well, the last time that the Oracle of Omaha was left missing out, similar to today, was 1998 to 2000, as shown in the chart below.

1998 to 2000

Similar to today’s environment, those years into the turn of the century many thought Mr. Buffett had lost his touch or became out of tune with the markets.

Well, it took a few years, but he was ultimately proven more than correct. “Value Investing” returned with a vengeance the following decade-plus and drastically outperformed “Growth.”

So paraphrasing Mr. Graham’s quote again, it is important not to forget our key investment principles when they are needed most. The next few years will likely be where they are needed most again.

As the Sun rises in the East and sets in the West, we will see this Growth vs. Value dynamic shift yet again.

Have a nice weekend. Our office will be closed on Monday. We will be back, dark and early on Tuesday.

Mike Harris