For those of you who would prefer to listen:

The United States Federal Government is set to shutdown at midnight Sunday. This, unless there is an 11th-hour continuing resolution agreed to by Congress, which looks doubtful at best. I outlined some of the implications of a shutdown last week. The Market has been taking it pretty much in stride all along. In fact, the Market has absorbed multiple pressures all year and rallied in the face of it. September brought a continuation of the Stock Market sell-off. This is typical corrective price action, which historically leads to a rally into year-end.

Higher interest rates and higher yields are designed to choke off spending and cool the Economy with the ultimate goal of taming inflation. These are the Fed’s favorite tools. They’ve been used aggressively. Rates and yields have spiked in 2023 unlike any other time in decades. It’s created some serious stress within the financial system while other areas of the Economy have still flourished. Time is needed for the tools to thoroughly work. But the banks were caught offsides and suffered immediately.

I’ve been asked multiple times this year about the safety of brokerage firms in the wake of the Silicon Valley Bank failure and First Republic take under. It’s completely understandable and a very valid and appropriate concern.

The most important thing to understand is the fact that owning stocks and bonds directly means you are a shareholder of the company or the direct lender to a corporation or government entity in the case of Treasuries or municipal bonds. The point is, regardless of where an investor’s brokerage account is held, that’s merely held in what’s called “street name.” The securities are directly held in a central depository known as “DTC.” It’s like the central nervous system for securities.

The Depository Trust Company (DTC) is the world’s largest securities depository. Founded in 1973 and based in New York City, the DTC is organized as a limited purpose company and provides safekeeping through electronic record-keeping of securities. It’s the centralized clearing house. Individual investors don’t interact with DTC, but the brokers do. The largest banks and brokers are active DTC participants. They deposit and hold securities in this central holding company.

DTC records trade settlements at the end of each daily session and sends the records to the brokers. DTC holds over 1 Million securities issues valued at nearly $90 Trillion. It safeguards the global financial system. DTC is overseen by the Securities and Exchange Commission (SEC).

Before DTC was formed, the brokers exchanged certificates by hand. Hundreds of messengers were employed to carry certificates and checks. The process of transferring securities and record-keeping relied heavily on pen and paper. The exchange of physical stock certificates was difficult, inefficient, and increasingly expensive. It could not keep up with the growing demand.

Most stock exchanges require DTC-eligibility prior to the listing of a security. The benefits are many. Transparency, safety and efficiency are atop the list. The mission: “Throughout the lifecycle of a security, DTC helps boost efficiencies, reduce risk and lower costs for participants, issuers and investors. The benefits begin with the eligibility/underwriting process, which enables the initial distribution of a security offering to be made electronically to financial institutions that are DTC participants and ultimately to investors.”

How investors hold securities determines what happens when they buy and sell, as well as how they receive communications, including annual reports and voting proxies, and the way any dividends would be paid.

By far the safest, cheapest and most common approach is to have brokerage accounts in street name, like Schwab. The investor’s name is listed on its brokerage firm’s books as the beneficial owner of the shares. DTC holds legal title to the securities and the ultimate investor is the beneficial owner.

DTC handles the transfer of cash and stock to the appropriate investment bank or broker. They then pass it on to their investors. By maintaining custody of eligible securities, DTC eliminates the risk of a missed election on a corporate action, or a missed dividend payment. That’s critical, particularly if an investor changes brokers. Shareholders are owners of companies. No matter where the account is, all the records remain at DTC.

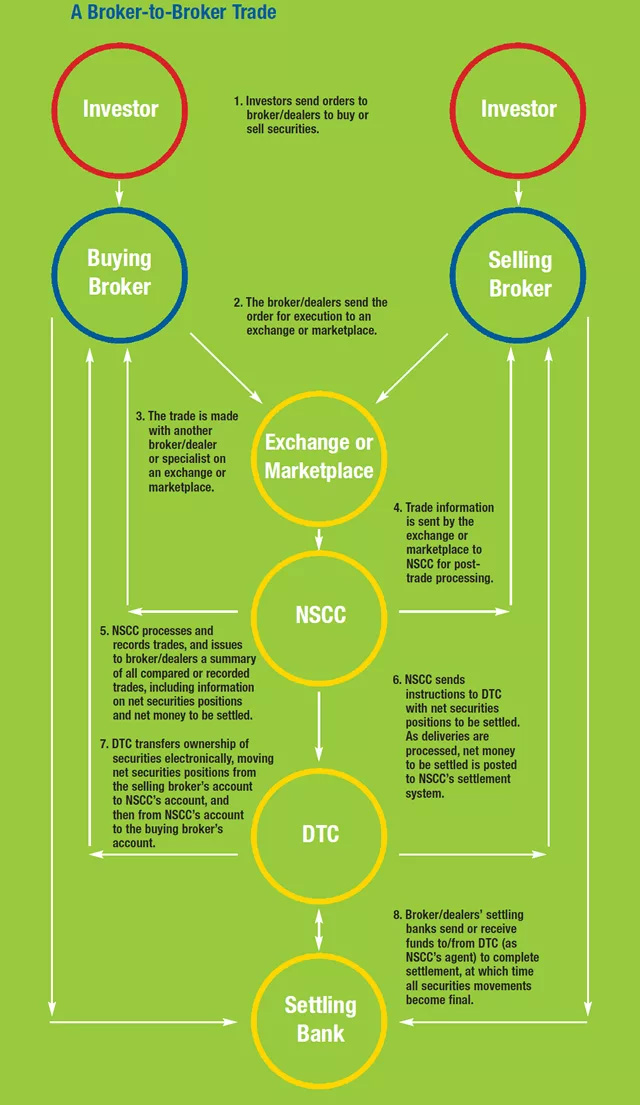

Here is a visual:

Back to the Market:

Stocks closed out the month and the quarter in the red. Inflation keeps ticking down at the core level, but food and energy prices are back on the rise, which is sucking Dollars away from other areas of the Economy. That should keep the Fed on hold with higher rates for longer pretty certain. The excesses built up over the Summer keep getting burned off within the correction.

Despite the wide swings, the Stock Market has basically gone sideways for 2 years. The gains for 2023 are more than offset by the losses in 2022. In fact, the S&P 500 is in the exact same place it was in the Summer of 2021.

We expect this corrective price action to continue a bit more before a year-end rally attempt. Our Fall newsletter will go out next week, outlining our thoughts and strategies. We are staying defensively positioned for now, but plan to switch gears when things settle down.

Have a nice weekend. We’ll be back, dark and early on Monday.

Mike