You often hear buzzwords from us like managing risk, or risk-adjusted returns, or the importance of a balanced portfolio. We want to show you why these words are so important. Retirement is unpredictable in many ways. Investment returns for one are highly unpredictable. The last 10-15 years have definitely been a living testament to that.

What is predictable is that volatility in investment returns will occur, then repeat, and repeat again into perpetuity. It is our job in these unpredictable markets to manage risk. Sometimes rather than focusing on growth, it is much more important and prudent to worry about not losing money or losing less money in a bad market environment. Sounds very counterintuitive and it is. Let’s see how it works.

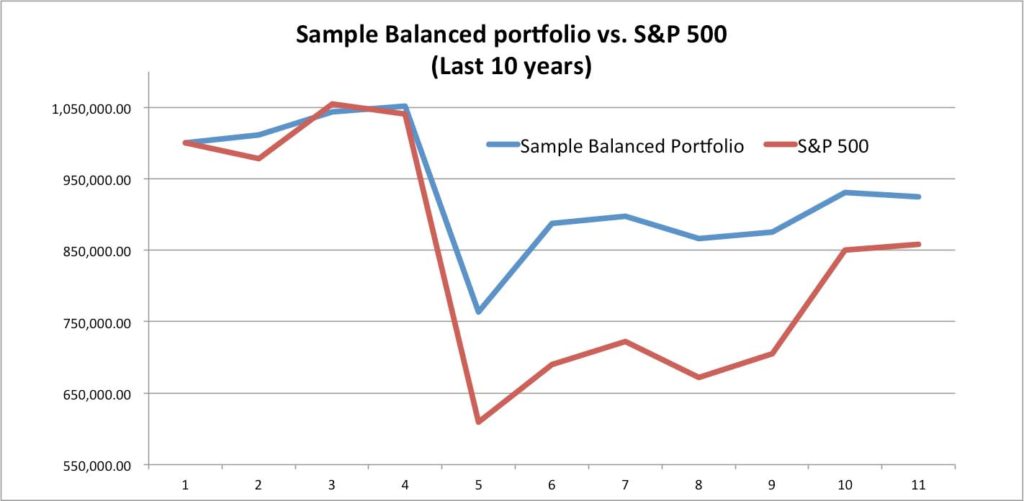

We are going to look at two sample portfolios. Since you can’t control when you retire and the investment returns thereafter, we thought this was as good a time as any to use a random time period and do the analysis from there. We didn’t know what the numbers would look like when we started, but we had a hunch. Since the last 10 years have been anything but ordinary and 10 years is a long enough statistically significant time period, we made assumptions that a person or family that retired exactly 10 years ago with a $1,000,000 portfolio and has since withdrawn $50,000 annually or 5% of the initial portfolio.

The first sample portfolio was invested passively in the S&P 500 for the full 10 years and completely at the mercy of whatever the stock market did. This would be a 100% Equity or stock investment strategy. $50,000 was withdrawn annually. The red line on the chart below illustrates what that portfolio would look like today. It would have finished at $858,106. For reference the S&P went from 1211 to 1985 over the past 10 years. That is a 64% total return, yet the portfolio after $500,000 of withdrawals was almost 15% lower due to the impact of those annual withdrawals.

The second sample portfolio was invested in an actively managed balanced portfolio of stocks and bonds for the past 10 years. $50,000 was also withdrawn annually. The chart above illustrates what that portfolio would look like today in blue. It would have finished at $924,649, fairing better than the passive all-stock counterpart.

For reference the total return would have been around 60%, which was lower than what the S&P 500 generated.

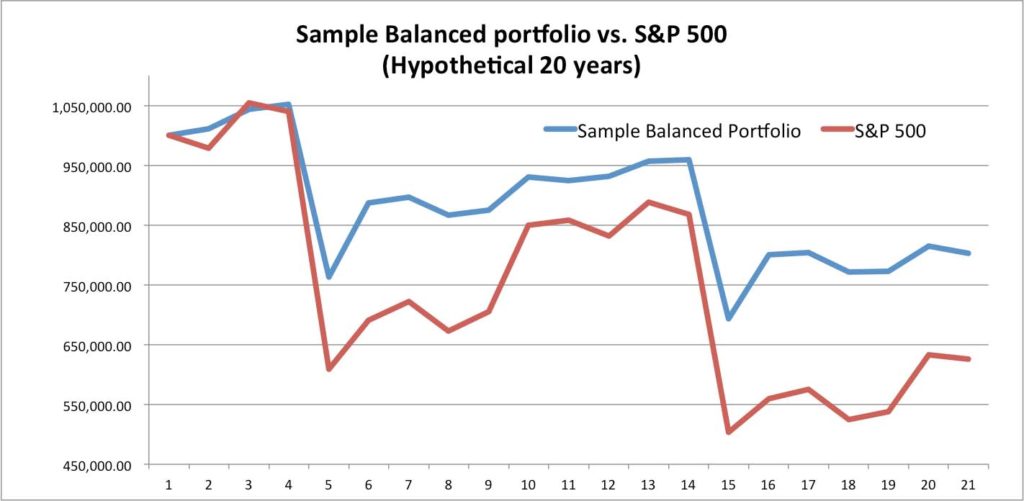

Wait, how can the percent of returns be lower, but the remaining portfolio balance be higher after 10 years? This is the beauty and ultimate power of risk-management and a draw-down factor on a portfolio in bad times. When a portfolio is stressed like it was in 2008 in the passive S&P 500 at -38% and then has withdrawals on top of it, it creates lower dollar amounts to be compoundd moving forward. Let’s take it a step further, after all retirements last longer than 10 years! Let’s take the tough last 10 years of returns and simply assume they repeat again for the next 10.

The passive all stock sample portfolio would have an ending balance of $625,701 after 20 years of withdrawing $50,000 a year. (Shown in Red below)

The balanced portfolio would have $803,131 after the same time and withdrawals. (Shown in Blue below)

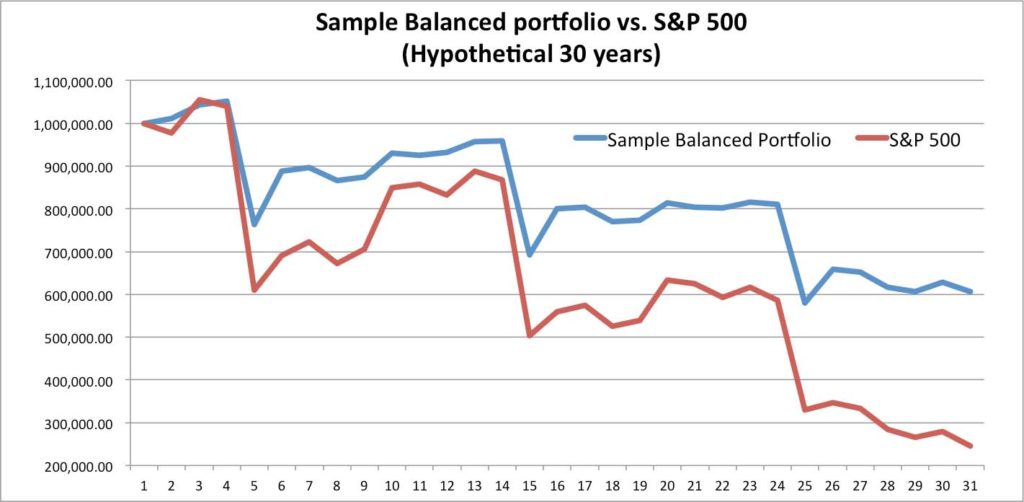

And let’s do it one more time for the full-effect, 30 years is a better retirement length anyway.

After 30 years of withdrawing $50,000 a year the passive all stock portfolio’s ending balance would be $245,484. (Shown in Red below)

The actively managed balanced portfolio balance would be $607,156. (Shown in Blue below) Wow a big difference.

Over 30 years the actively managed Balanced portfolio generated over 310% in returns, but still came in 30% lower than the passive Broad Market or S&P 500 which produced a +337% clip.

Yet the 100% passive stock portfolio in the S&P 500 ended up with $245,484vs. $607,156 or $361,672 less than the lower risk, actively managed Balanced portfolio.

This Hypothetical example illustrates the true power of Risk. Risk can be expressed by the Standard Deviation of Returns, or essentially the volatility in a portfolio: the extreme ups and downs. Simply put, the less a portfolio goes down in bad times while money is getting withdrawn, the more money available to bounce back up during good times. This is why we preach the power of risk-adjusted returns and the significant benefits of a healthy balanced portfolio.

Portfolio Management sometimes is more about losing less and protecting capital in bad times, than it is about how much can be made on the upside. This is an important concept and one not easily grasped. Hopefully this highly hypothetical exercise went a little bit towards illustrating this point.

We don’t know what the next 10 years worth of investment returns will bring. We do know that we will experience both good and bad markets again. It won’t repeat the same way ofcourse.

Our goal remains to grow capital at a reasonable rate of return given the market risks at that time. We respect risk, and take it very seriously. We look forward to making the best decisions we can to provide a smooth 30+ year journey for you.

We hope you found this example helpful. We are here if you have any questions. Have a good weekend.

By: Mike Harris