The Dow closed back above 20,000 after Friday saw the best performing day of the year. The rally was sparked by today’s employment report which saw a healthy labor market pick up for January.

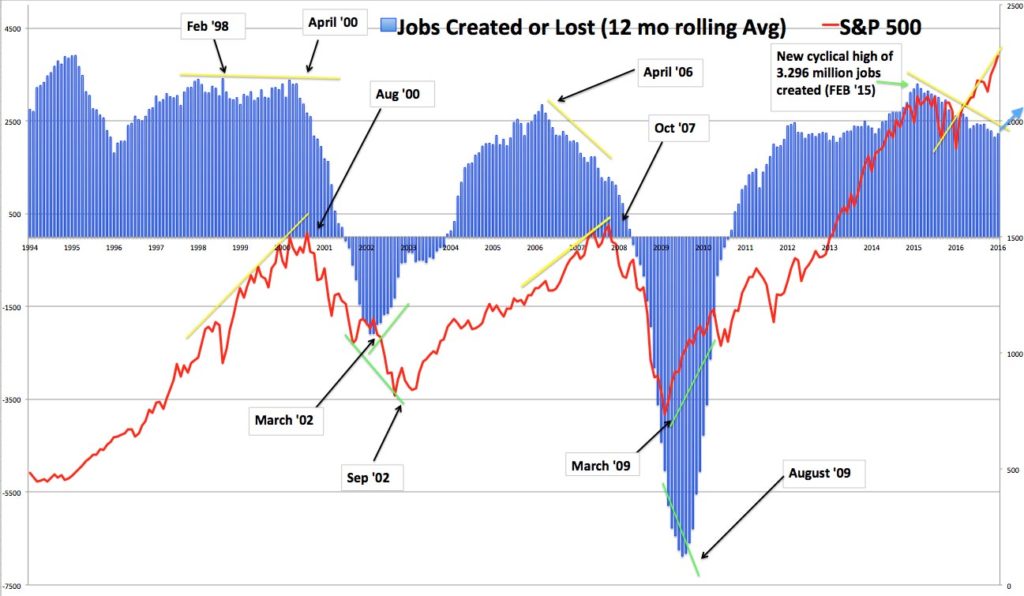

Jobs can often times diverge from the Stock market for quite some time, but ultimately the jobs market does matter as it’s a healthy barometer of economic activity. We do not consider these Job reports to be leading indicators, but rather offer us a good gauge of perspective. Two recent stretches come to mind: From ’98-’00 the jobs market created no net new jobs to our economy for 2 whole years while the markets raced up 36%! We call this a negative economic divergence. We saw it again from ’06 through the end of ’07 where the job market actually deteriorated substantially while the stock market raced up another 20%.

From February of 2015 through last month, the job market had been gradually slowing; creating almost a million less jobs at the end of 2016 vs the beginning of 2015. It’s just one of the many reasons we saw the early 2016 correction in the markets. These slow patches are pretty normal throughout history and only become a problem if they don’t improve. Our thesis going into year end was that the labor markets were set to snap back and improve in 2017 based on many healthy economic indicators we monitor closely.

Many of the economic barometers such as new manufacturing order production, inventories, supplier deliveries, service contracts all started to firm and begin to really strengthen into last Fall. Our experience has shown us that when our work here is strengthening it’s only a matter of time till it shows back up in a tighter labor market. That is exactly what we saw today, a good positive start economically to 2017 and a good confirmation that our Bull thesis is intact.

SUPER BOWL FUN: With no Bay Area team in the Super Bowl this year we have been wondering who to root for this weekend. Since we are always rooting for the stock market we look toward the Super Bowl Indicator for inspiration. The Super Bowl Indicator came to life based on a column written by New York Times sportswriter Leonard Koppett in 1978. It says that a win by an original NFL team (before the 1966 merger pact) means the stock market will be up for the year. A win by a descendant of the AFL league means the stock market will go down for the year. Teams created after the merger count for their conference, National or American.

So what does this mean for Sunday’s game? Well if you have no pony in the race…The Super Bowl Indicator would say if the Falcons win, the market will go higher, and if the Patriots win the market will go lower. While this indicator has proven accurate 76% of the time in the past 50 years it is important to note that this correlation does not have a cause-and-effect relationship. And to be clear are we in no way using this in our investment inputs!!!

So, if you want to join in the fun and want to root for the market to continue its rally, stick with rooting for the Falcons!

By Mike Harris & Meredith Rosen