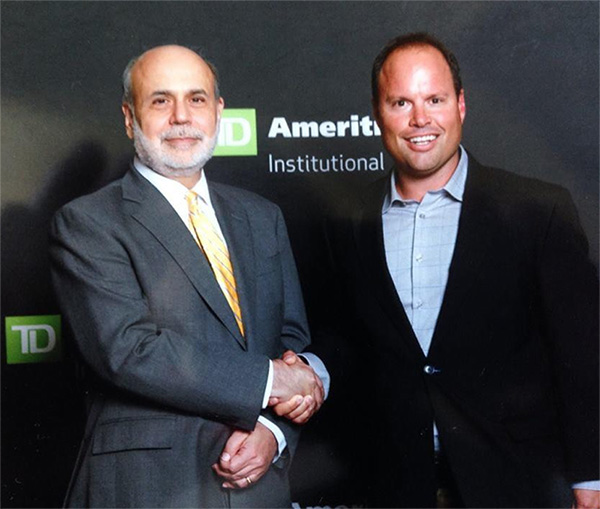

Recently, I had the privilege of meeting former Dallas Federal Reserve President Richard Fisher. He spent the last 10 years working under Alan Greenspan, Ben Bernanke, and Janet Yellen. Fisher was very influential during the Financial Crisis. Mr. Fisher shared the thought process within the Federal Reserve. It was a fascinating experience, particularly since I had met Bernanke a year ago who had chronicled his tenure at the Fed. The stories were very similar. Their jobs were extremely difficult and vitally important.

Fisher has great respect for all three Fed Chairs he served. He categorized Greenspan as a libertarian when it came to monetary policy. “This allowed for system manipulators to run amuck”, in Fisher’s words. The result was what Fisher called a massive storm of disintegration in the financial system. By the time Bernanke took over in 2006, the roots of the problems were growing precipitously. Bernanke believed in efficient markets. Unfortunately, he found himself in an environment where efficient markets failed.

The Bernanke-led Fed was a big believer that history repeats itself. Ben Bernanke studied the Great Depression. Bernanke, Fisher and crew modeled their response from the Panic of 1825 in England. In Fisher’s words, they pulled out all the stops to combat the crisis. They threw money at the problem. He said that Congress was useless. Bernanke had the same claim. Under Greenspan, excess reserves at the Fed were $25 Billion… but today are $3 Trillion. The Fed’s balance sheet went to $4.6 Trillion, where it still stands today: Enormous!

Richard Fisher worries there are 4 banks holding over half of US deposits. They are JP Morgan, Citigroup, Bank of America and Wells Fargo. These are the banks that are too big to fail. In Fisher’s mind, they are too big to exist. Smaller, regional banks are choking on over-regulation even though they make things happen across the country in small town America. Fisher’s major concern is the fact that post-2016, nobody has a clue about American tax policy or the Congressional budget. It is very difficult to make projections in running a business or planning your financial future without clarity on tax treatment. That is a responsibility of Congress. It’s no wonder Congress continues to have historically low approval ratings.

Richard Fisher is optimistic about America’s future. The healing process from the financial crisis continues but we have not yet escaped the damage. There’s more to go, which continues to complicate Janet Yellen’s Fed. Fisher has great confidence in Yellen’s leadership. He believes Ben Bernanke is a heroic figure, and admires him tremendously. Fisher is a great American in his own right.

Happy Father’s Day!

Mike Frazier