10 years ago today, on a Sunday evening, word leaked out that Lehman Brothers failed and that it would file bankruptcy first thing Monday morning. In addition, it was announced that Merrill Lynch was being acquired by Bank of America, something that was not even publicly considered heading into the tumultuous weekend. It was the weekend that saw the Global Financial system freeze and Capitalism nearly broke. I will never forget that weekend…

The fail of Lehman Brothers was the cresting moment of the Financial Crisis which was years in the making. In the wake of the recession caused by the Dotcom bubble bursting in 2000 and exacerbated by the effects of the September 11th attacks, a new asset bubble was created. It was in real estate. Low interest rates and a strong dislike for stocks after getting burned sent money chasing properties throughout the United States. Foreign money came too, in size. New home construction surged. Houses were sold well over asking prices, sometimes within hours of listing. House flipping became a lucrative sport. Pretty much anyone with a pulse could get a loan. The loans were packaged and securitized, then sold as high-quality AAA rated investments with outsized yields, but would prove to be rotten at the core. Lending restrictions were out the window as big bets were made on the premise that home values would never go down. They kept going up. And up. And really up. Before they came crashing down.

The housing market cracked in 2006, but didn’t start experiencing sharp declines until 2007. This created a cascading effect with mortgage delinquencies to follow. Those presumed high-quality AAA securities began to rot. Credit default swaps flourished then blew up. A credit default swap was basically insurance on debt. By mid-2007, there was more than $45 Trillion invested in swaps. That’s more than the money invested in the U.S. Stock Market, mortgages, and U.S. Treasuries combined. A Money Market broke the buck for the first time, which means it was worth less than the $1 in $1 out model after writing off its Lehman debt it owned which resulted in its new value of 97 cents. Even money market funds consisted of risky assets, unbeknownst to virtually everyone at the time. Money Market funds quickly moved back to Treasuries and other government backed securities for safety. That’s where most remain today, and where they belong in our estimation.

Before Lehman Brothers, there was Bear Stearns. Earlier in the ballooning crisis, Bear Stearns was fighting for survival. It was the 5th largest American investment bank at the time. On a Monday morning in March of 2008, 6 months before Lehman Brothers failed, Bear Stearns was taken under by JP Morgan for $2 a share. It was later negotiated up to $10, but the message was clear, and the belief was that a potential disaster was avoided. No systemically significant US financial firm had failed since the Great Depression. Lehman changed that.

I vividly remember the Friday heading into the weekend on September 12, 2008. The question was who was going to buy Lehman Brothers, because its survival was improbable. The rumors had circulated that a standing offer was in place for a Korean bank to buy Lehman. But they walked away. Also in the mix was believed to be Barclays, the large British institution, as well as Bank of America. A meeting coordinated by the Federal government was taking place all weekend in New York City. The question was not if, but merely who. What transpired Sunday night caused a firestorm. Lehman Brothers was left to fail and Bank of America was swallowing up Merrill Lynch, who wasn’t officially on the table that weekend. The implications were that the current state of affairs was heading towards calamity. The largest retail broker, Mother Merrill, needed to be saved. Merrill Lynch was deemed too big to fail. Lehman was not. Whether it was forced or not, the decision was made and the consequences were completely unknown.

Lehman shocked the system. Pure and simple. But the biggest issue became the American International Group, better known as AIG. It was failing too and was far more consequential. The Federal Reserve claimed that AIG had enough collateral to justify being saved, whereas Lehman didn’t. The AIG bailout was really a backdoor rescue of the vast number of financial institutions around the world. AIG was a huge part of the global financial plumbing and that perhaps was not completely understood until 2008. The plumbing was clogged and the pipes began backing up. An AIG failure was believed to be catastrophic. AIG had been AAA rated. Can you believe that? AIG was also too big to fail. If that was the case, then it was realistically too big to exist. Saving AIG was widely unpopular for good reason. Former Fed Chairman Bernanke still steams over AIG.

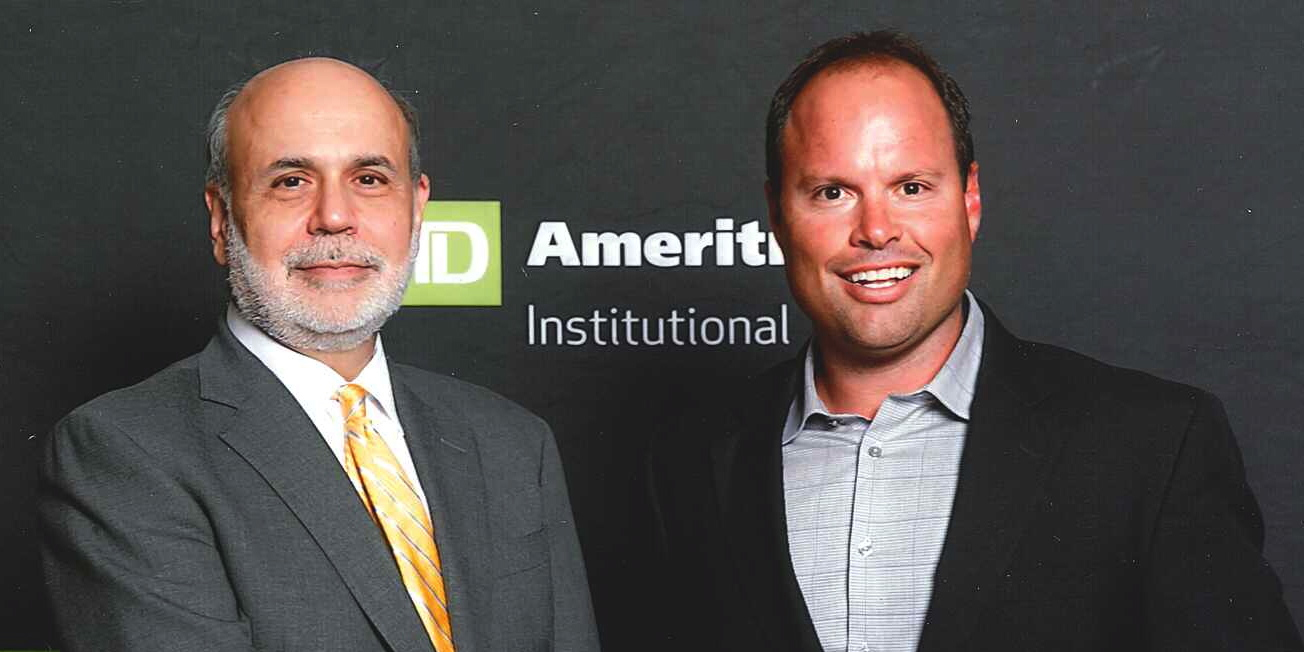

The response to the crisis was clearly controversial. It is still hotly debated 10 years later. But when you consider this was completely uncharted waters, action was needed with no guarantees. I personally believe Fed Chairman Ben Bernanke and Treasury Secretary Hank Paulson were heroes. Congress did nothing to help by maintaining the party line politics which are even more divisive today. There were no tax cuts levied or aggressive support in the form of Fiscal policy. Congress was more of a critic and blockade than help. Bernanke and Paulson were the first responders and in many ways were forced to act alone. Secretary Paulson remembers: “We came so close to really going into an abyss. It could have been much worse.”

The world got a wakeup call on risk. After surviving 2 massive Bear Markets within 10 years’ time, investors were badly burned and had little trust. Who could blame them? As Mark Twain said, “We should be careful to get out of an experience only the wisdom that is in it and stop there lest we be like the cat that sits down on a hot stove lid. She will never sit down on a hot stove lid again and that is well but also she will never sit down on a cold one anymore.” Investor confidence is still on the low side, despite 10 years of a Bull Market. The wounds from the Financial Crisis run deep. Without trust, a market is nothing. The younger generation has learned and learned the hard way. Many have passed on home ownership, preferring to rent, and don’t trust big banks or the Stock Market. It’s really hard to qualify for loans today.

This current Bull Market, which was born in the ashes of the Financial Crisis, sprouted green shoots in the Spring of 2009. It is now the longest living Bull Market in American history. It’s also perhaps the most distrusted if not hated Bull Market in history. That comes from its origin. Someone had to go down in the crisis. Lehman was the one. Capitalism cracked that day. In capitalism, to win you have to be able to lose. Over 700 banks received federal aid. The recurring issue is the fact that investors and taxpayers paid the highest price during the crisis to Wall Street’s benefit. It’s hard to argue against that. But the alternative was probably even worse. Taxpayers were not only paid back, but made a profit on the bailouts and backstopping. Investors that held on have experienced an explosive rally to new all-time highs on the S&P and DOW in 2018.

After 10 years, is the next crisis just around the corner? Bubble formation has been the theme leading to collapse. That was the case with the Dotcom bubble in 2000 and the Housing bubble in 2008. In 2018, what catches our attention is the mounting debt. The banking business is the strongest perhaps it’s ever been. But cheap money has encouraged government, companies and people to take on debt. There’s a lot of it. The historically low interest rates have fueled imbalances between asset prices and income. Assets have grown much faster than wages in recovery. Rising interest rates will make it more expensive to service that debt. The debt can and has been kicked down the road for quite some time. It won’t last forever. We’re studying it closely.

Have a nice weekend. We’ll be back, dark and early on Monday.

Mike