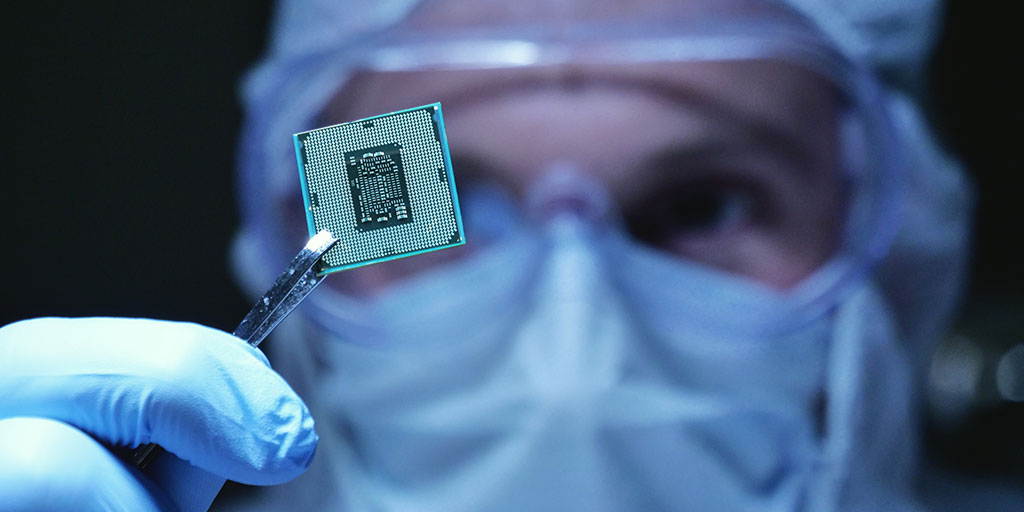

Whatever device you’re reading this on, it’s powered by semiconductors. Chances are, semiconductors drive your TV and refrigerator too. They’re everywhere and inside nearly every electronic device. Remember the slogan: “Intel Inside?” It was like a badge of honor or stamp of quality. The implication was that an Intel processor made for the best computer, and it generated tremendous brand loyalty. That campaign rolled out in 1991 and lasted a couple of decades. Intel dominated the PC industry. The Digital Age has seen the semiconductor industry explode. It’s just incredible to think about how much has changed in so little time.

Semiconductors are embedded in a vast number of products these days. They’re often described as the brains of electronic devices. Semiconductors enable technologies critical to economic growth, national security, and global competitiveness. Semiconductors have been far-reaching in developing innovative products and industries as the Digital Age evolves. They have driven advances in Communications, Health Care, the Military, Transportation, Energy, and countless other industries and applications. You name it, chances are they’re in it. Semiconductors are foundational for the expansion of the Internet of Things, machine learning and AI; And there is a major shortage right now.

The Global Pandemic triggered a surge in demand for PCs, video games and other digital devices as remote work, online learning and digital entertainment became the new normal. Demand still remains at highs. The vast majority of products in our daily lives use semiconductors. They allow them to function. Chips are in smartphones, digital cameras, televisions, washing machines and dryers, ovens and refrigerators. Semiconductors play a central role in the functions of systems from ATMs to trains. In virtually every way today, semiconductors help us live a more comfortable life that is based on dependable technology.

For reference: A semiconductor is a material that conducts electricity in some cases, but not in others. Silicon is the most common. Good electrical conductors, like copper or silver, easily allow electricity to flow through them. Materials that block the flow of electricity, like glass, rubber or plastic, are insulators. Insulators are used to protect people from electric shock. Quite simply, a semiconductor does not conduct as well as a conductor. Pretty straight forward. Semiconductors are the foundation of modern electronics. The terms semiconductor, integrated circuit and chip are often used interchangeably in society. They’re really not though. A semiconductor is a broad, general term. There are microprocessors, memory chips and integrated chips, which are types of semiconductors. A chip generally has a single use. You get the point.

The American semiconductor manufacturing model has changed over the years. Outsourcing has been a theme and for a while. Chips used to be primarily made in America. Now, they’re mostly designed on American soil and manufactured overseas. The US used to manufacture roughly 40% of the global semiconductor supply 3 decades ago. It is just 12% today. Foreign governments have offered US semiconductor companies significant incentives and subsidies to incentivize and create facilities in their countries, most of which are in Asia. Low-cost labor and manufacturing costs have attracted American multi-nationals to outsource production, which significantly increased profits. That was a key driver in Globalization.

Many of the top semiconductor companies are now what’s called “fabless,” meaning they only design the chips and the technology inside of them. Manufacturing companies, known as foundries, are contracted to actually make the chips. The dominant leaders now are TSMC in Taiwan and Samsung in South Korea. The shift to outsourcing has had a big effect on structural changes and related capacity. If a company cut orders in the early days of the pandemic, they had to go to the back of the line.

A run on chips in recent months has strained global supplies of critical components in a range of electronic devices that have been in demand as people work from home during the coronavirus pandemic. Automakers have been especially hard hit by shortages of chips that go into numerous systems, from modules that manage engines to automatic braking and assisted driving technologies. Last Spring, at the height of the Crash, car manufacturers thought the recovery would take years, so they dug deep into their inventories instead of buying new chips. It normally takes roughly 26 weeks from when a car company orders a chip to delivery. They certainly did not anticipate the swift recovery.

The global semiconductor shortage has hit many American industries hard, especially the Auto sector. This got the attention of the Biden administration. The CEOs of Intel, Qualcomm, Micron, and Advanced Micro Devices signed a letter urging President Biden to provide substantial funding for incentives for semiconductor manufacturing as part of economic recovery and infrastructure plans. An executive order will reportedly be signed in the coming weeks to authorize supply chain reviews for critical goods like silicon chips. President Biden urged Congress to move quickly on a large infrastructure improvement plan, declaring that China is poised to “eat our lunch” otherwise. The chip industry has said the semiconductor crunch points to the need for more investment in US manufacturing and research, and is hoping for government incentives to pump Billions of Dollars into that effort.

Cars have become the ultimate mobile device, and today are filled with chips. That’s only going to increase with the move towards electric and autonomous vehicles. The shortages have forced auto plants across the world to slow down or stop assembly lines entirely as auto makers try to redirect scarce chips to their most profitable models. Both Ford and GM announced this week the negative impact on business due to the chip shortages. Volkswagen said in December that it was reducing output at many of its factories around the world. The Auto industry is home to Hundreds of Thousands of American jobs.

The Trade War played a major role too. US-China tensions caused some chip makers to shift manufacturing from China to Taiwan. Those changes interrupted manufacturing as the chip designers adjusted their supply chains and fabrication moves from one factory to another. China is a much bigger player today. They are a big buyer as well as manufacturer of chips. They want the rest of the world to buy theirs. The Western World is on guard. Taiwan is caught in the middle of so many geopolitical issues. The United States does not want dependence on China for anything. That’s the issue. There is a seemingly obvious solution.

A return to semiconductor manufacturing could be in the offing for the United States. Part of our investment thesis for the decade ahead has been the return of many supply chains back on American soil. From chips to medicine, American made can solve our challenges. We need more chips and we need more jobs. The thinking is, there’s a dual opportunity for success. An infrastructure package could include government investment in building the biggest and best complex of semiconductor foundries in the world. Made in America, by Americans, for Americans. That sounds pretty patriotic. It also sounds like smart business, if the economics align properly.

Semiconductors used to be so cyclical. In the Digital Age, they’re a staple and way of life. That’s not going to change. It’s only going to increase. Artificial Intelligence and the Internet of Things have entered the system. The growth is real. The possibilities are endless. It impacts all things Economic, Social, Political, and Geopolitical. It starts with a chip. It’s all very investable.

Have a nice weekend. The Market is closed on Monday, in observance of President’s Day. We’ll be back, dark and early on Tuesday.

Mike